We’ve seen some substantial changes to the Australian car market over the past 18 months, not least the steady proliferation of new brands onto the scene.

Now we’re past the halfway point of 2023 it seemed an opportune time to take a breath and evaluate the performance of each, and revisit what’s to come.

BYD

Of all the new or newish brands on sale, rising Chinese electric vehicle-focused behemoth BYD has had the most outsized early impact on the Australian car market – racing to number-two in the electric vehicle (EV) sales charts behind Tesla before even clocking up 12 months in-market.

While the Atto 3 EV rollout was not without its snags – namely a stop/sale due to BYD’s importer failing to tick all the Australian Design Rule check boxes – it’s now up and running, and customers here have already received multiple over-the-air updates.

The company has already imported more than 10,000 units of the Atto 3, with 6196 of those sales recorded across 2023. Only the Tesla Model Y (14,002 sales) and Model 3 (11,575) have sold in greater numbers this year, with BYD nabbing about 14 per cent EV market share.

Much of this is down to its ability to flood the market. Since BYD makes its own chips and batteries, it is less buffeted about by global supply chain snags. It also pivoted to drive finished cars off the factory line into shipping containers, skirting quarantine-related port delays.

BYD’s masterplan is to achieve 50,000 annual sales here over the next few years, supported by an expansion of its EV line-up – including the sub-$40k Dolphin, the BYD Seal sedan, another SUV, and an electric ute, which we’ve already captured deep in testing.

With this in mind, Australian publicly listed car dealer giant Eagers Automotive Ltd announced this week that it had plowed an additional $70 million into a retail joint-venture to sell BYDs both online and in stores.

MORE: BYD news and reviews

Chery

Remember Chery? It had an unsuccessful crack at the Aussie market between 2011 and 2014 with the budget J1 and J3 hatchbacks, and J11 small SUV, through a deal with independent distributor Ateco.

But Chinese brands move fast, and its products have come a hell of a long way inside the past decade. As someone unfortunate enough to have driven a J1 many moons ago, that’s good to see, because it was a shocker.

The first car launched under its new factory-owned operation is a small SUV called the Chery Omoda 5, a sharp-looking competitor for the top-selling MG ZS and GWM Haval Jolion – all Chinese-made budget runabouts that are storming up the charts.

The Omoda 5 is off to a pretty strong start after only a few months on sale, with sales figures showing 1612 of them are already out-and-about on Aussie roads. With 603 deliveries in June, the Chery outsold luminaries like the Nissan Qashqai and (supply hit) Mitsubishi ASX.

What comes next? Naturally enough, two more SUVs, called the Chery Tiggo 7 and Tiggo 8 – both of which are slated to come with petrol and plug-in hybrid (PHEV) powertrains. In 2024 it will launch a fully electric Omoda 5 EV to compete with the Atto 3 and MG ZS EV.

“We’re getting priority shipment, we’re getting priority production; everyone is watching us. So it gives us a lot of confidence that the operations globally are geared and ready for us,” Chery Australia marketing director James Curtis told us.

MORE: Chery news and reviews

Cupra

Cupra is part of the Volkswagen Group, like Skoda or Audi. But this Spanish subsidiary brand sets itself apart with a sportier look and feel, and in Australia a greater range of electric and PHEV offerings.

The company opened its order books to Australians in July 2022, meaning we’re almost a year to the day past that. Over this period of time the company has sold 2700 vehicles, including 1586 over the first half of 2023 – more than Peugeot, Genesis and Fiat.

Cupra says it’s actually taken more than 3000 orders since opening for business in Australia – a third of which are for its all-electric Born, and PHEV Formentor and Leon. The Cupra Born is the first mainstream EV from the Volkswagen Group to hit Australia.

The upstart aims to have 15 of its Cupra Garages in operation throughout Australia by the end of this year, up from the current nine, which in its words “sets us up really nicely for that 2025-26 wave of new product as well”.

Cupra’s team has indicated it wants to have an annual sales volume of 7000 vehicles in the Australian market by 2025 (it also has a 500,000 unit target worldwide), with the second wave of new models coming mid-decade.

These next-generation models are expected to include a new entry electric hatchback called the Cupra Raval, the Tavascan crossover EV, and the larger Terramar mid-sized SUV, expected to come with with a choice of petrol or plug-in hybrid powertrains.

MORE: Cupra news and reviews

Polestar

Polestar began life as a venture between Volvo Car and its Chinese parent Geely, which subsequently sold off a stake via IPO to drive its product development – headlined by the goal of making a fully “climate neutral” car by 2030.

In its first year on sale in Australia it sold an impressive 1524 units of its sole launch vehicle: the Polestar 2 electric liftback, a rival for the Tesla Model 3. That made it the fourth top-selling EV overall behind the Model 3 and Model Y, and BYD Atto 3.

The company sold a further 1147 Polestar 2s over the first half of 2023, has rolled out over-the-air updates to existing cars such as this one, and branched out beyond online-focused ordering with its first flagship retail location at Melbourne’s massive Chadstone Shopping Centre.

Before the launch of another model, the Swedish-Chinese brand will instead launch a heavily updated Polestar 2. Unlike Tesla which is cutting prices, the new model costs a few grand more than before, but has more range and more driver-assist features.

These coincide with significant mechanical updates, including a virtually unheard-of mid-life switch from front- to rear-wheel drive for single-motor variants.

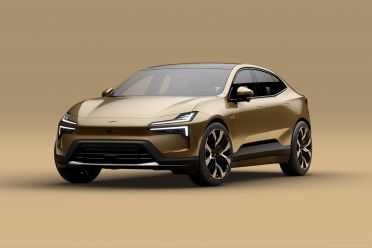

What comes next? The Polestar 3 large SUV (which shares a platform with the new Volvo EX90) arrives in early 2024 priced around $140,000, ahead of the Porsche Macan-rivalling Polestar 4, and the Polestar 5 GT, billed as a Porsche Taycan and Audi e-tron GT rival.