Matt Campbell

2025 Porsche 911 Carrera T review

6 Days Ago

News Editor

General Motors is expecting to double its revenue by 2030 as it continues to transition to electric vehicles, and plans a product onslaught to push Tesla to second in the US EV market.

The company made this and many other announcements at its Investor Day at the Global Technical Center in Warren, Michigan.

Revenue from electric vehicles alone is projected to grow from around US$10 billion (A$13.73b) in 2023 to $90 billion (A$123b) by 2030, though GM will still be counting on revenue from internal combustion-engine vehicles like its profitable full-sized pickups and SUVs.

For context, GM’s total revenue for the 2020 fiscal year was $US122 billion (A$167b).

There’ll be new revenue streams, too.

The company’s autonomous mobility division, Cruise, is projected to deliver US$50 billion (A$68.6b) in annual revenue by the end of the decade.

It’s planning to operate a driver-less ride-hailing service in San Francisco.

GM’s new BrightDrop division, which is developing electric delivery products and services for commercial customers, is expected to bring in US$5 billion (A$6.86b) in revenue by mid-decade.

This could potentially increase to US$10 billion by the end of the decade, with 20 per cent margins.

It’s readying a full-sized electric van using GM’s Ultium technology, called the EV600. It’ll be joined by a smaller EV410 in 2023.

Software and services revenues, including those from connectivity platform OnStar, could be in the $20-25 billion range (A$27.46-34.33b) by the end of the decade with a projected 30 million connected vehicles on the road.

“Simply stated, we are at an inflection point in which we expect revenue to double by 2030 while also expanding our margins,” said Paul Jacobson, executive vice president and chief financial officer.

“We will achieve this by growing our core business of designing, building, and selling world-class ICE, electric and autonomous vehicles, growing software and services with high margins and entering and commercializing new businesses.”

It’s aiming to deliver margins of 12 to 14 per cent by 2030.

To get there, there’s still plenty of investment required.

In the medium-term, annual GM capital spending is expected to be in the US$9-10 billion range as the company transitions to a majority electric portfolio.

GM is also investing nearly US$750 million (A$1.03b) in charging infrastructure through 2025.

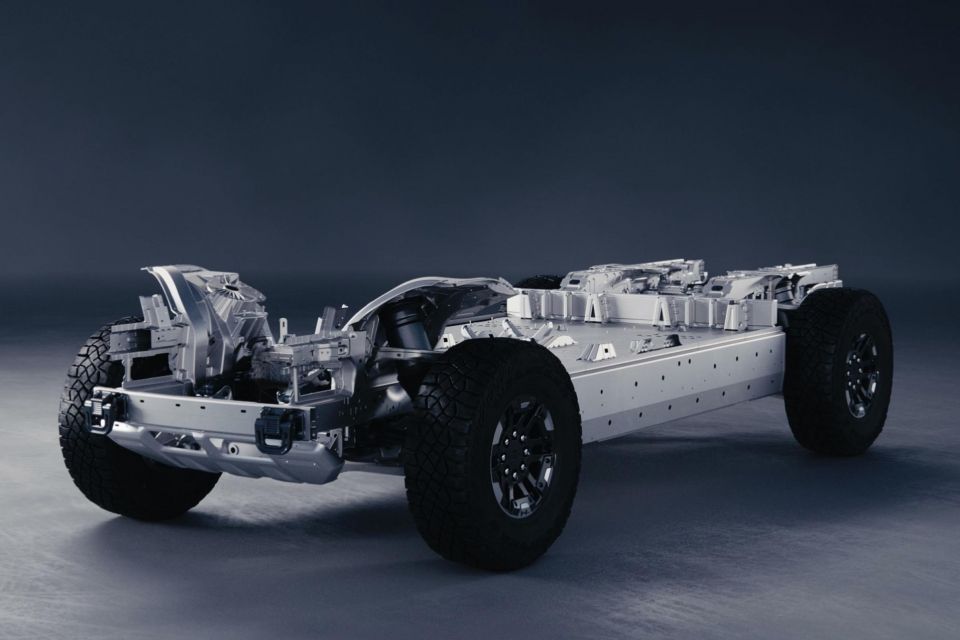

Its electric transformation will well and truly kick into gear in 2022, with its first model on the new Ultium electric architecture – the GMC Hummer EV – commencing deliveries later this year.

It’ll be joined by the GMC Hummer EV SUV in 2022, along with the Cadillac Lyriq.

By 2025, it’s aiming to sell more than 1 million EVs annually and by 2030 it’s aiming for half of its US and Chinese plants to be capable of producing EVs, with a new plant being set up to build electric pickup trucks.

GM has already confirmed it’s investing US$35 billion (A$48b) in electric and autonomous vehicles through 2025 and plans to launch 30 new electric models by then.

By 2035, it aims to become an all-electric automaker.

New products will include a new Chevrolet SUV that will cost around US$30,000 (A$41,202) – US$3000 less than even the new Bolt EUV – and will be sized similarly to the current Equinox, recently sold here as a Holden.

A smaller and cheaper Chevy EV is also planned, while there’ll also be an electric version of the larger, two-row Blazer, related to the GMC/Holden Acadia.

These models are expected to use GM’s modular Ultium architecture.

There will also be new Buick SUVs, luxury Cadillac models including an opulent Celestiq flagship, and an electric Chevrolet Silverado.

The latter will debut at the 2022 Consumer Electronics Show, and will likely be followed by an electric GMC Sierra pickup truck.

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

William Stopford is an automotive journalist based in Brisbane, Australia. William is a Business/Journalism graduate from the Queensland University of Technology who loves to travel, briefly lived in the US, and has a particular interest in the American car industry.

Matt Campbell

6 Days Ago

James Wong

5 Days Ago

Max Davies

3 Days Ago

Josh Nevett

2 Days Ago

Josh Nevett

2 Days Ago

Paul Maric

18 Hours Ago