James Wong

2026 Nissan Ariya review

3 Days Ago

Modelling by an electric vehicle lobby group says the Australian car industry will meet proposed CO2 targets over the next several years.

News Editor

News Editor

The Electric Vehicle Council says its modelling shows the Australian car market will meet targets under proposed emissions regulations.

The electric vehicle (EV) lobby group has used automotive data firm S&P Global Mobility’s new car market forecast in developing its modelling, which assumes business as usual and doesn’t take into account the differing vehicles carmakers may introduce in the face of the Australian Government’s New Vehicle Efficiency Standard (NVES).

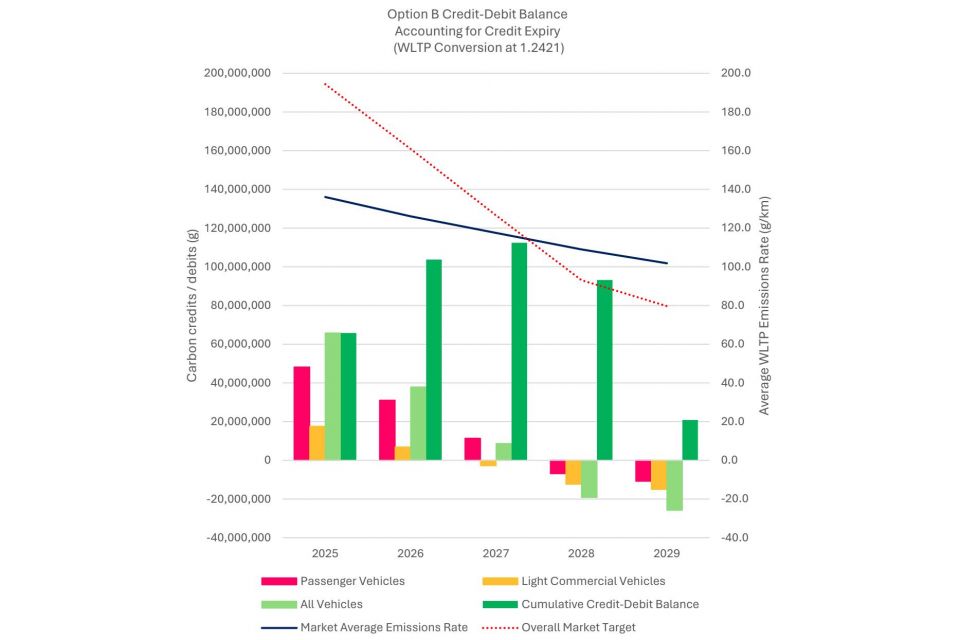

Its modelling shows Australia will achieve the overall CO2 targets in 2025, 2026 and 2027 under the government’s preferred Option B.

Moreover, it says that while the car market overall will emit more CO2 than the targets for 2028 and 2029, surplus credits accrued by carmakers in 2025 and 2027 will offset this as under Option B credits will last for three years.

However, this data doesn’t show how individual carmakers would perform.

The Electric Vehicle Council notes the light commercial vehicle category will start to exceed its category CO2 target in 2027.

Under the NVES, carmakers will be given targets for average CO2 emissions per kilometre across their vehicle fleets. Over time this CO2 target will move, forcing companies to provide vehicles with lower or zero emissions to meet stricter targets.

If companies meet or beat their CO2 target, they’ll receive credits. If they miss it, they can either trade credits with a different supplier, make it up over a set period, or pay a penalty.

The price of trading carbon credits isn’t yet known, though the lobby group says this is generally around 40-50 per cent of the penalty rate per international standards.

It argues it’s “deceptive and misleading” to simply calculate the credits/debits using the penalty rate, as this isn’t the price at which the majority of credits will be purchased.

It’s worth noting the S&P Global Mobility forecast uses WLTP values for vehicle CO2 emissions, while Australian measurements are based on NEDC testing. However, as with the Australian Government’s impact analysis for the NVES, the data firm has used an approximate conversion factor of 1.2421 x NEDC to convert to WLTP figures.

It takes the forecast annual sales of a model and multiplies it by the tailpipe CO2 emissions rate, with the sum of these values across all models providing the total market carbon.

In turn, the total market carbon allowance is calculated by multiplying the annual NVES target for each vehicle category by the forecast annual sales for each vehicle category.

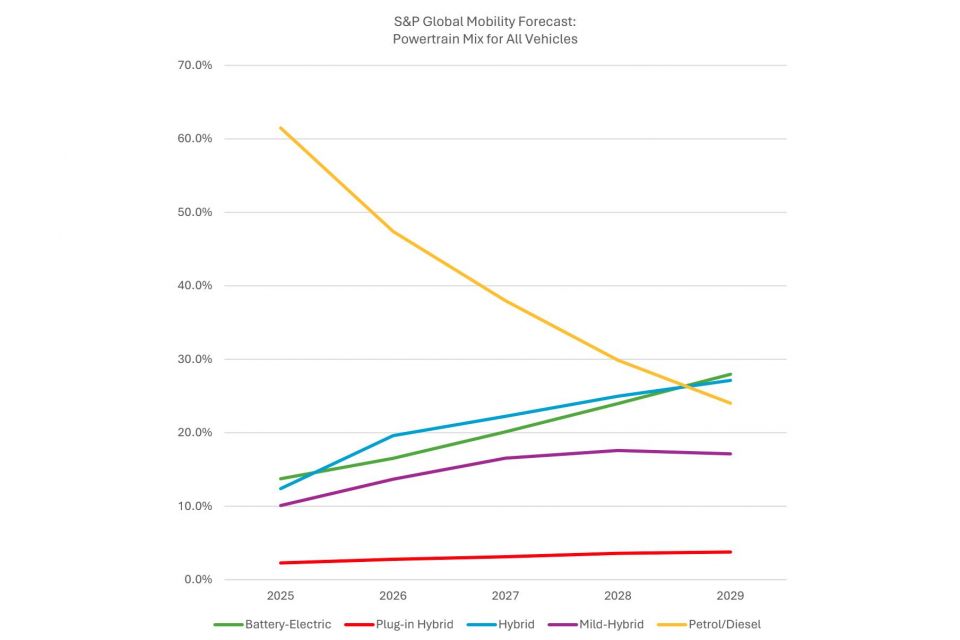

The S&P Global Mobility Sales-Based Powertrain Forecast finds electric vehicles will account for 28 per cent of all new vehicle sales in 2029, with hybrids just behind at 27 per cent, mild-hybrids at 17 per cent, and plug-in hybrids at just 4 per cent, with combustion-powered vehicles making up for the rest.

As it doesn’t take into account the proposed introduction of Option B of the NVES, the Electric Vehicle Council argues it’s a conservative projection of electric and hybrid vehicle adoption.

The data nevertheless shows EV market share will double between 2025 and 2029 and hybrids will rise from 12 per cent market share in 2025 to 27 per cent in 2029. Plug-in hybrid share is projected to remain essentially flat.

Looking at light commercial vehicles (i.e. utes and vans) specifically, electric options are expected to grow from 3 per cent market share in 2025 to 8 per cent in 2029, showing passenger cars and SUVs will do the heavy lifting.

Nevertheless, the firm still projects sales of purely combustion-powered commercial vehicles to dive from 91 per cent to 51 per cent in 2029.

Electric Vehicle Council chief executive Behyad Jafari says the S&P Global Mobility projections for EV sales in 2029 are far lower than where he’d like to see the market by then, but that Option B “at least locks this change in and provides a good base to build from”.

“The reality is that ‘Option B’ New Vehicle Efficiency Standards won’t actually push the market to significantly change what it was already going to do,” Mr Jafari said.

“Importantly, this modelling is based on the same data being used by the old car lobby. This means they’ve known that this standard will create a huge excess of credits that can be traded as an offset to anyone who misses their target, but they’ve been lobbying to make it weaker anyway.

“What this analysis tells us is that any move to make this standard much weaker risks adding so many additional credits into the market that we won’t even be able to guarantee existing projections.

“That’s clearly what some greedy voices in the car lobby are shooting for and the government must reject this.”

He called the standards a “massive benefit to Australian consumers” even if a handful of individual carmakers “may be grumpy”.

“While these standards are lower than where most Australians and the electric vehicle sector would like to see the market land, as a reasonable stakeholder in this process we’ve been willing to back Option B as a compromise,” he said.

“Now it’s up to the government to build on this position and show that it won’t cave to scare campaigns being run by the most unreasonable parts of the industry.”

While only a handful of carmakers have publicly released their submissions to the government, many have at least put out their general position on the NVES.

Mazda was the first to speak out against the emissions regulations, calling for them to be delayed to next decade and arguing carmakers won’t just absorb any penalties they’re charged for exceeding their CO2 target.

“Obviously this will get passed onto the price of vehicles in one form or another without being a direct tax or charge or levy,” Mazda Australia managing director Vinesh Bhindi told CarExpert in February.

“Our opposition is that I think the timeframe is too ambitious, and secondly maybe the government hasn’t really educated themselves on the costs that would go to the consumer in this big ambition they have shared with us.

“A timeframe from 2030 to 2035, one we’ll have more technology available and probably a better value proposition, which would mean that our government doesn’t have to be as aggressive on incentives would be the appropriate timeline.”

Subsequently, a number of carmakers have said they support elements of the government’s preferred option but are calling for elements of the government’s more lenient Option A to be adopted like reduced penalties, different vehicle categorisation, and consideration of other types of credits.

These carmakers include Ford, Hyundai, Isuzu, Nissan, Toyota and Volkswagen.

Others have commented publicly or released statements that are more broadly supportive of the proposed Option B, including GWM and MG.

MORE: All our coverage on the New Vehicle Efficiency Standard

William Stopford is an automotive journalist with a passion for mainstream markets and historical automotive pieces.

James Wong

3 Days Ago

William Stopford

3 Days Ago

Josh Nevett

2 Days Ago

Paul Maric

1 Day Ago

William Stopford

19 Hours Ago

Damion Smy

18 Hours Ago