James Wong

2026 Nissan Ariya review

3 Days Ago

News Editor

SsangYong is just weeks away from selecting a bidder.

The South Korean SUV and ute manufacturer has been working with a court-appointed sale advisor, Ernst & Young Hanyoung, to find a buyer.

They’ll choose both a preferred and a secondary bidder by mid-October 2021, with a deal set to be signed in November.

The selection of a bidder had originally been slated for the end of September.

“We are planning to announce the selection of a preferred bidder for SsangYong around Oct. 12 after thoroughly reviewing the bidders’ funding plans to acquire SsangYong,” an EY Hanyoung official told The Korea Herald.

The three bidders are Los Angeles-based start-up Indi EV, a Korean consortium led by electric bus manufacturer Edison Motors, and another consortium led by Korean firm Electrical Life Business and Technology.

None of these companies currently produce electric vehicles, or SUVs or utes in general.

The Edison consortium said it’s setting up a special purpose company to raise between 800 billion and 1 trillion won (A$938 million to $1.17 billion) to acquire SsangYong.

It then plans to increase capital by issuing new shares next year, with the aim of getting the company back in the black within 3-5 years.

Should it be successful in its bid, it also plans to transition SsangYong over the next decade into a manufacturer of electric vehicles only.

The Korea Herald reports the consortium has ambitious plans to produce 10 new EV models by 2022, 20 by 2025, and 30 by 2030.

Those lofty numbers suggest it’s referring to individual variants and not model lines.

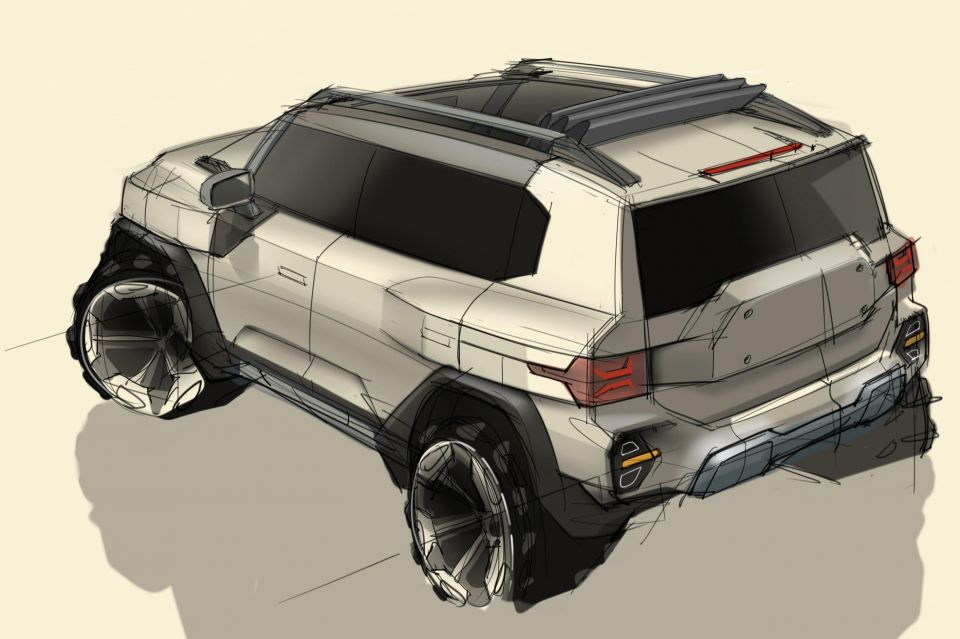

SsangYong has already commenced production of the Korando E-Motion, and has released sketches of two other all-electric SUVs in development: the KR10 and the J100.

The company is planning to sell its Pyeongtaek plant near Seoul over the next few years to build a new factory designed specifically for electric vehicles.

SsangYong’s 4700 employees started taking two-year unpaid leave in rotation in July, and have also accepted an extension of wage cuts and suspended benefits until June 2023.

Korean companies SM Group and K-Pop Motors have declined to enter bids, while Cardinal One Motors has also withdrawn.

According to Korea JoongAng Daily, SM Group reportedly declined to bid as it concluded SsangYong wasn’t ready to become exclusively a manufacturer of EVs.

Cardinal One Motors, headed by CEO Duke Hale who helmed HAAH Automotive Holdings, had spoken publicly of plans to import SsangYongs into the lucrative North American market, in which the brand has never been sold.

These plans had been suggested after plans to import and sell Chinese Chery models had fallen through.

The three bidders have stepped up after SsangYong’s owner, Mahindra & Mahindra, confirmed it was looking to sell the company in April 2020. The Indian company currently has a 74.65 per cent stake in it.

SsangYong was placed into court receivership in April 2021, one step short of bankruptcy in the South Korean legal system.

It’s estimated up to 1 trillion won is needed to take over SsangYong due to its massive amounts of debt.

SsangYong’s history has been tumultuous. Before Mahindra took over, it was owned by Chinese SAIC Motor until it entered receivership in 2009 amid the global financial crisis.

SAIC Motor had acquired a 51 per cent stake in SsangYong in 2004. Prior to that, Daewoo had a controlling stake from 1997 until 2000, when its own financial troubles forced it to divest.

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

William Stopford is an automotive journalist with a passion for mainstream markets and historical automotive pieces.

James Wong

3 Days Ago

William Stopford

3 Days Ago

Josh Nevett

2 Days Ago

Paul Maric

1 Day Ago

Ben Zachariah

16 Hours Ago

William Stopford

16 Hours Ago