Anthony Crawford

1972 Lamborghini Jarama S review

6 Days Ago

Senior Contributor

It’s coming up on three years since Canadian Stephen Lester decided to move, with his family, to Australia to run Nissan’s local division.

He had been the managing director of the company’s premium brand Infiniti based in Ontario. Before that he was an executive at BMW Canada, and a marketing manager.

Nissan had gone through some tough times before his appointment. He replaced former Mercedes-Benz sales director Richard Emery in the Nissan role, who was himself preceded by Americans Bill Peffer and Dan Thompson in the role.

Each had different visions and ideas for the business, and it was clear that it would take some time for Lester to address the myriad issues on his plate.

Ageing products, multi-franchise dealers considering where to put their stretched resources, and the loss of several key models that became left-hand-drive only propositions, all come to mind.

Nissan’s market share has fallen from 6.0 per cent in 2000 and 2010, to 4.8 per cent. And its annual sales (well, claimed sales, though in years past we know some brands found ways to inflate them more than today) have gone from nearly 63,000 cars a decade ago to just under 51,000 last year.

But the affable Lester, who has been friendly and accessible since day one, has clearly put his stamp on things. And after laying the groundwork, it looks like the right products are in the pipeline for growth.

He’s also embraced ‘footy’ (AFL) and Aussie slang rapidly. No small feat, that.

Stephen Lester: Like everyone it’s obviously much more complicated in terms of getting certain things done, but on the other hand we’ve got a lot to be thankful for here and in New Zealand in terms of how things have been handled, and as well in terms of the great talent that we’ve got within our business.

I’m just really grateful for the team we have and our dealers, who have adapted to the changing environment. We have done some things that, had a proposal been brought forth [in normal times], would have had a very extended timeline in order to execute, but those things have been rolled out remarkably quickly and seamlessly.

It’s been an amazing effort and the team has proven they’re up to the challenge.

SL: It certainly has flown by, it’s hard to believe. We’ve had such a good time here and we’re looking forward to keeping that good time going further into the future.

We’ve had a lot of activity within our business for sure. From a surprising standpoint I would say the volume of brands we’ve got in this country is still astounding. It’s remarkable, it almost seems like new ones are popping up in spite of the challenges in the marketplace over the last few years, and the decline in the TIV.

So that’s been really quite remarkable and it’s different from a North American perspective where brands don’t come and go quite so often.

The other one is certainly from a finance perspective, I would say coming from a market that is much more finance-centric with things like leasing. We’ve been able to roll out in the last year Nissan Future Value, and the way people think about payments or repayments… is something that has certainly surprised me from the outside.

But the team has been remarkably adept at bringing the products to market and we’ve seen in the last 4-5 months a marked gravitational pull towards that type of purchase.

SL: Without a doubt people’s attitudes towards how they purchase things are going to change and evolve, you only need to look at all the… changes with COVID-19, with online consultations, and social distancing to keep retail operations going. We were actually selling cars in April and it’s a testament to the fact that people are able to adapt and adopt new ways of doing things.

The leasing aspect for consumers is a great way to own a vehicle differently, to have peace of mind, and ultimately enjoy changing that vehicle over more frequently.

SL: Certainly COVID-19 has been an impetus for a lot of sudden change, there is no doubt about that. We’ve mobilised our entire head office to work from home in less than 10 days, and as well our dealers are learning how to operate their businesses in completely different ways and changing their operational structures to enable social distancing.

To a certain degree so far customers are interacting with dealers in that digital manner and are doing things like come-to-you test drives and all sorts of activities that address the way consumers want to be interacted with… people will come to adapt to that, whether it’s remote service, or the actual end purchase.

[But] there will be some things the bricks and mortar dealership is still required for in the future, and that physical touch and feel. It’s a very emotional purchase experience, not every consumer just wants the ‘go in and buy the car and get out’ type of thing, they want to enjoy the process and go through it with a knowledgeable salesperson to keep them informed on what is often the second largest purchase a person makes.

So we feel it’s going to be a comfortable balance between the two and as always it’ll be led by consumer’s demand.

SL: …I like a deal as much as the next person, it is traditional and customary that you negotiate the price of the vehicle you ultimately pay at the dealership, and I think that insofar as consumers would be able to negotiate on anything they buy, they would.

It just so happens that you’re going to have a tough time negotiating the price of certain commodities like Milk at Woolies.

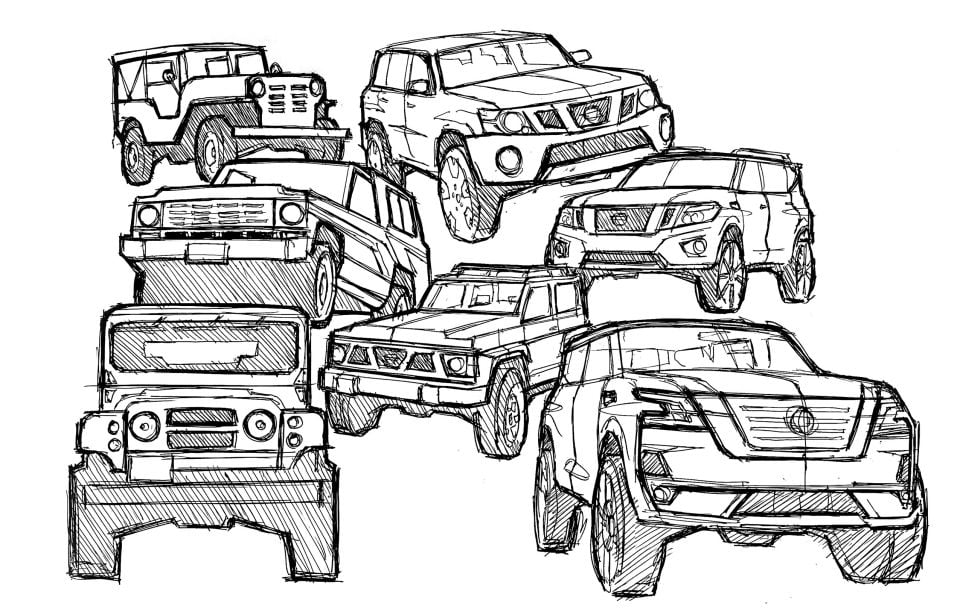

SL: Warrior no question has been a resounding success for us. Up until all of a sudden COVID-19 the numbers and the pull through that we were receiving from dealers was very positive. Now, COVID hasn’t diminished that, other than to say that the volume across the board will naturally come down with the April results, which won’t seem as robust as we’d normally like, but that’s just a fact of the overall market.

Our enthusiasm for carrying Warrior through to other nameplates is still there, certainly with the Premcar team we have a winning relationship and they delivered a great product… and we have worked on Patrol.

That’s, I would say, paused at the moment simply because of the current operation of both our businesses, we lack the horsepower at the moment. But we will get that back to normal, and I am quite confident that the pull through on Patrol will be an opportunity for the future.

SL: In the future certainly there’s an opportunity for Patrol and for a Warrior version of it, [and] there are still lots of things going on with Premcar. In fairness it’s a joint effort and while we need to make sure the product works for both sides, that the business case comes together appropriately, I’m confident they remain as enthusiastic as we are.

SL: No question about that, I’ll selfishly tell you that I don’t miss an opportunity to share the great artwork we’ve got or the details of the product and how it came to life, and these products don’t happen in isolation.

The ability to bring a modified product such as this to the market doesn’t just happen within the market. Nissan as a company globally invests far too much in the brand to just let something ad hoc get pushed through without proper and necessary engineering and testing follow-through to make sure it is worthy of the Nissan badge.

So it is very well known, it gets a lot of input and questions from my colleagues around the world, and it’s really a testament to the strength of the team here in Australia, what they’ve been able to bring to life.

SL: There’s no question we are excited to be launching some new products in the market. I would say “slight” would be a very modest way to put it, it’s been a long time, and I’ve been vocal about that internally and with our dealers.

We’re very focused on the fact we’ve got brighter times ahead viz-a-viz new product. Juke is going to kick that off, in fact the Leaf did last year, but it’s been a slightly longer gap than we originally wanted [since then].

Juke is just around the corner, design-wise it’s stunning and fits really well in a growth segment… I think it will speak to a wide part of the market.

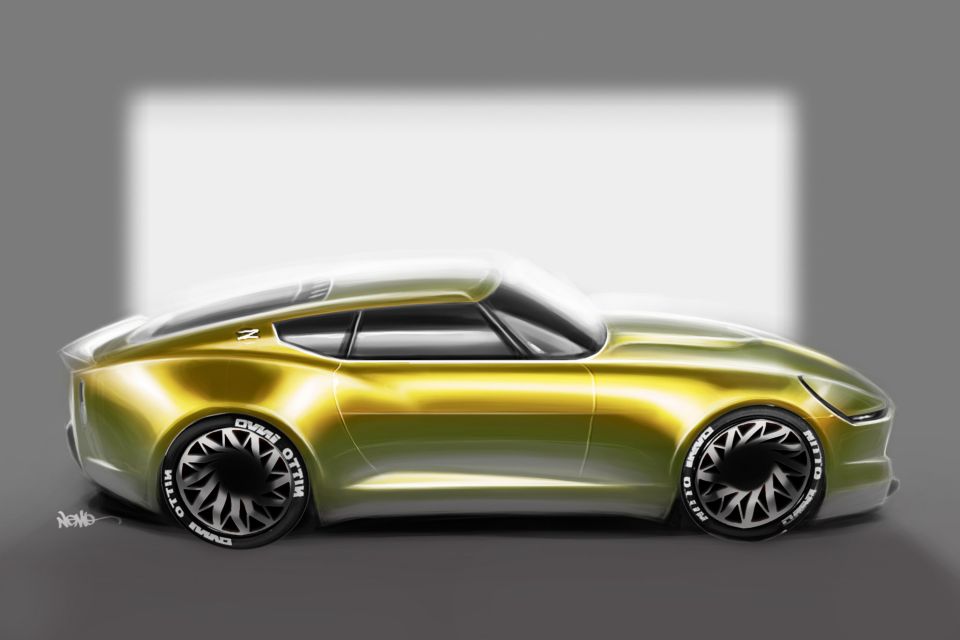

Of course with some of the other vehicles, I can’t comment on the future of Z per se, or the unfortunate details around X-Trail images [leaking], but we are obviously planning to have both of these vehicles as we go forward and I think we will really look forward to that growth in our model line up, plus a refreshing of current models.

SL: There’s no question that there are a few letters within the alphabet that are intrinsically connected to Nissan, our history, DNA really, as a Japanese brand that produces exceptional quality but also with a very strong bend towards performance and sports cars. That’s where GT-R and Z add that for the band.

Having those as halos, as you will, provides a dimension that some other brands aren’t able to brag about, or to bolster their overall brand, so we’re really excited. We just celebrated 50 years with Z, so that’s a tremendous amount of history and continuity, and we’re really excited about what Nissan has in store for us, and to present down the road.

SL: On Leaf there’s no question it’s a pioneer, and we’re really committed to electrification overall. We’ve been fairly vocal on the fact that a third or our range will be electrified by 2022 and we’re on track with that.

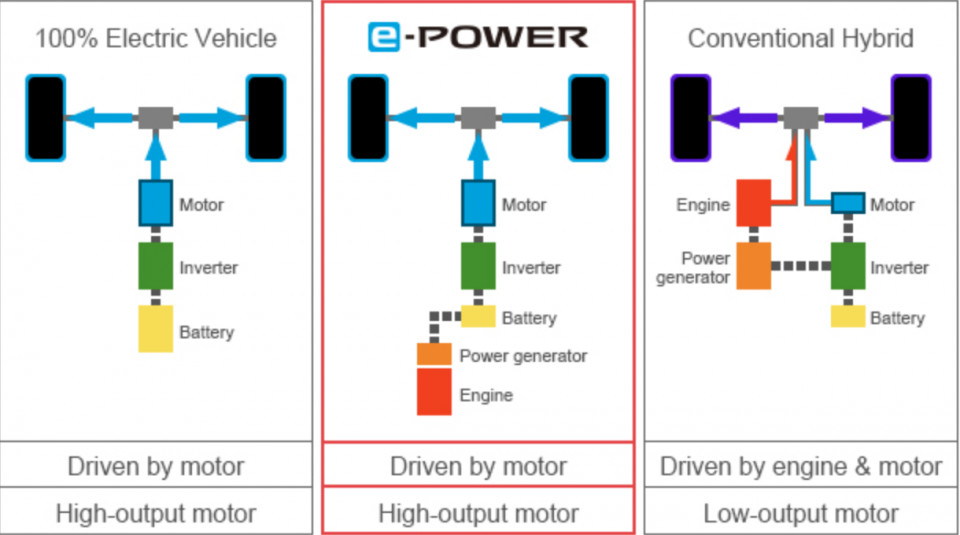

We see e-Power playing a key role in that, with the benefit of an EV’s quiet operation, instant torque and smooth operation, and then when you marry that up with e-Power fuel efficiency with a lack of range anxiety, fully electric to the wheels, gives us a great start for overall electrification.

And concepts like Ariya we would certainly be excited to see in Australia, and we will continue to push the team to get that here as quickly as possible. Whether it’s the look of the concept or hinting at what’s under the bonnet (a twin-motor system), it’s really exciting. The future is electrified.

SL: It hasn’t changed the approach, it just helps us validate our plans, and the fact the market is ready, and what we’ve been saying for a couple of years now is we have got to work towards being ahead of the curve on these things and not be as conservative necessarily, waiting on others to prove it can be done.

[Japan success of Note e-Power as the segment sales leader] bodes very well for this market, and Australians I think, will be excited to experience it.

SL: There’s no question. Its roughly 40 per cent increased range with the 62kWh battery and higher output overall would appeal to Australians, there’s no change whether it’s petrol, diesel or electric, Australians love performance, and Leaf e-Plus delivers that.

We’re keen to bring this car to Australia, and we believe we will have more details coming up on that soon..

SL: (Laughs) I certainly think it would have no problem going in Australia.

SL: The reality is there are certainly products in other markets that would work well here, and we’ve been a part of a number of business cases and plans to help bring some of those to Australia.

We definitely see an opportunity with the van space in particular and will continue to answer the questions from the global team on how to do that.

Micra.. would be a logical choice as well, and we’ll continue with the support of the region to bring those to market as soon as possible.

SL: There have certainly been a number of headwinds. Forex is probably one on the biggest challenges, we’re at five-year lows more or less against all of our major currencies, and so that does present a significant challenge to us, but we’re also looking at a TIV that is under a massive amount of pressure, dropping from near 1.2 million [annual new car sales] to slightly over a million.

So we’ve got to make sure that we can fulfil the [necessary] volume over time and that the product timing and life cycle timing is right and fits in with what our needs are. There’s no use bringing a product at the end of its life cycle, not that those products are necessary there.

SL: That’s a great question, and I think it can be easy to make excuses for not having products or utilising geography as a driver to that.

The reality is in our market we get nothing but support from the region and global team, we just need to continue to work on, from our standpoint, how we can focus on being able to deliver the right business case for each of those models, with the right timing and alignment.

With that we’ll get those key products.

SL: Pleasure.

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

Anthony Crawford

6 Days Ago

Max Davies

5 Days Ago

James Wong

3 Days Ago

James Wong

3 Days Ago

Max Davies

2 Days Ago

James Wong

6 Hours Ago