James Wong

2026 Audi Q5 review: Quick drive

5 Days Ago

Here are the men and women behind the world's largest automotive groups.

Journalist

Journalist

Automakers are driven by many things — profit, philosophy, brand image, internal culture — but also the person at the top.

Update, January 2021: Since we originally published this feature, Hyundai and Ford have changed their CEOs, and Stellantis has been created out of Fiat Chrysler and Groupe PSA.

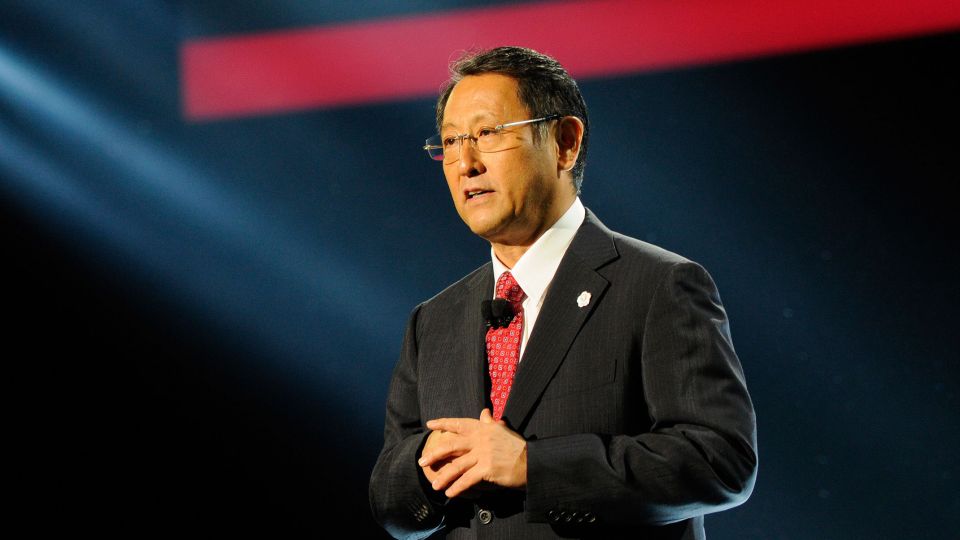

CEO since: 2009 Brands overseen:Toyota, Daihatsu, Lexus

Unlike other Japanese automaker chiefs, Toyoda has actively courted the limelight and is a well known figure in automotive circles.

Akio is the grandson of Sakichi Toyoda, the founder of Toyota Motor Corporation.

He became the president of Toyota in 2009 after CEO Katsuaki Watanabe was demoted due to quality control problems stemming from his drive to make the company the world’s number one automaker by volume.

After gaining law (Keio University) and business administration (Babson College) degrees, Toyoda joined the family company in 1984.

Probably with an eye on his future, he was posted to various positions all around the world, including production, marketing and development.

His roles since joining the board in 2000 have included running the company’s China, Asia and Middle East arms, and overseeing quality, IT and purchasing.

As has often been mentioned Toyoda is a racing driver and motorsports enthusiast. Because of this he established its Gazoo Racing arm, and championed the 86 into production.

His “fun to drive again” mantra didn’t make it through into mainstream vehicles until the first vehicles using the TNGA component set began entering production in 2017.

Although the company has been the leading advocate for hybrid drivetrains, it has been slower to dive into the world of plug-in hybrid and electric vehicles. It has also been slower to invest in self-driving car technology than its main rivals.

CEO since: 2018 Brands overseen:Skoda, Seat, Volkswagen, Audi, Porsche, Bentley, Lamborghini, Bugatti

After earning a degree in mechanical engineering, and then a doctorate in assembly automation, Diess joined Bosch in 1989.

He joined BMW in 1996. During his 19 year career at the luxury automaker, Diess ran the company’s UK plants before moving onto the motorcycle division. Heading upstairs, Diess was put in charge of purchasing and finally development for the entire company.

Diess joined the Wolfsburg-based firm in 2015 to become the brand chief of Volkswagen, and in 2018 he was made CEO of the entire Volkswagen Group, replacing Matthias Müller who ran the automaker for three years in the immediate aftermath of the Dieselgate crisis.

Although he didn’t initiate the company’s aggressive pivot from diesel to electric vehicles, he has charged on aggressively with plans to launch around 40 EVs based on the mainstream MEB and premium PPE architectures.

While all automakers are preparing to add electric vehicles to their lineups, Volkswagen has gone in hardest, with the Volkswagen Group’s mainstream brands planning to launch a range of EVs over the next few years and some factories being converted to solely produce electric cars.

Although Volkswagen has been open to licensing the MEB platform in order to build up economies of scale, so far only Ford – in addition to its wide-ranging ute and commercial van tie-up – has committed to building a vehicle on the architecture.

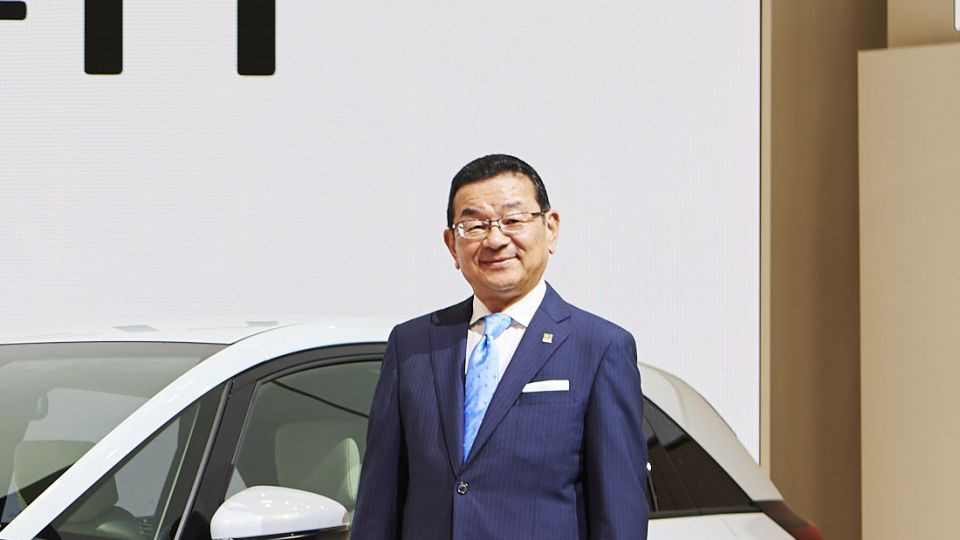

CEO since: Beginningof2020 Brands overseen:Nissan, Infiniti, Datsun

Nissan’s world began unravelling before Coronavirus made its debut on the global stage.

In November 2018m as his private jet touched down in Tokyo, Carlos Ghosn was arrested for improper use of company funds and under-reporting his income.

At an astonishing press conference on the day of the arrest, Ghosn’s hand-picked successor as CEO, Hiroto Saikawa, denounced his former mentor, talked down his legacy, and pledged to reform the company’s governance structures.

Less than a year later Saikawa was forced to step down after admitting to being overpaid due to some creative accounting surrounding Nissan’s stock-payment plan.

Makoto Uchida, formerly the head of Nissan’s China division, was selected to occupy the company’s hot seat.

Uchida began his working life at Nissho Iwai, an import/export company handling everything from metals, machinery, lumber and textiles to food, fuel and chemicals.

He joined Nissan in 2003, and critically has experience working with Renault, Nissan’s main partner in its automotive alliance.

In 2006 Uchida was a manger at the Renault Nissan Purchasing Organisation, and in 2016 he became head of Alliance Purchasing.

From 2012 to 2014 Uchida served a stint at Renault Samsung Motors, the French automaker’s South Korean satellite brand.

Ever since Ghosn was arrested, the grievances and mistrust bubbling away under the surface of the alliance have popped up more regularly in the press.

It’s hoped Uchida will be able to make the Renault-Nissan-Mitsubishi Alliance work again. The company is expected to announce a significant downsizing soon, and will look to concentrate its development and sales efforts on three key markets: Japan, China and the USA.

CEO since: July 1, 2020 Brands oversen:Renault, Dacia, Alpine, Lada

As noted above, Renault and Nissan find themselves in a difficult spot at the moment: trying to move on from the Ghosn era, making their alliance work again, and dealing with the fallout from the COVID-19 pandemic.

After Ghosn was arrested and subsequently dethroned Renault was led briefly Clotilde Delbos, the automaker’s chief financial officer. She was replaced on a permanent basis by Luca de Meo at the beginning of July 2020.

De Meo was most recently the head of Seat, the Volkswagen Group’s Spanish marque, which is pitched at those wanting a more sporty feel and better value than the German automaker’s main brand.

During his time at the helm of Seat, the brand launched a crossover for every major European class, expanding its sales and profitability. De Meo also oversaw the launch of Cupra as its own standalone brand.

While de Meo’s automotive career began at Renault in 1992, he didn’t really start stepping into the limelight until he was put in charge of European product planning for the Toyota Yaris and Lexus ranges.

In the mid-2000s he became head of the Fiat brand, and in 2009 he joined the Volkswagen marque as its chief marketing officer. He became Audi’s head of marketing in 2012, and took on the top job at Seat in 2015.

CEO since: 2014 Brands overseen: Chevrolet, Buick, GMC, Cadillac, Wuling, Baojun

The first woman to run a major automaker, Barra has practically been at GM her entire working life.

Barra began her career at GM inspecting panels on the Pontiac Grand Prix line when she was a university co-op student.

She has worked in the company’s engineering department, and rose through the ranks to become the plant manager of the Detroit Hamtramck factory.

She became CEO in 2014 after roles as the global head of human resources, manufacturing engineering, product development, and purchasing and supply chain management.

During her tenure as CEO she has worked to free the company of divisions that have proved unprofitable. Most famously she sold the company’s European arm, featuring the Opel and Vauxhall brands, to the PSA Group, owner of the Peugeot, Citroen and DS marques.

Under GM’s aegis Opel/Vauxhall failed to post a profit since 2000, but once brought into French control, the brands were turned around to profit within a year.

The company has also retreated from India and much of Africa, and this year announced it will stop developing vehicles in right-hand drive, meaning it has had to shutter Holden in Australia.

By shedding these (largely) unprofitable divisions, GM is putting most of its eggs into the baskets labelled: North America, China, and Latin America.

While Barra has shrunk the company’s production and sales base, she has made big investments in electric vehicles, starting with upcoming Cadillac range and the GMC Hummer pickup truck, and autonomous driving, via the Cruise self-driving taxi division.

Ever since she assumed the top job at GM, she’s been a regular in the top 10 most powerful women according to Forbes, mixing it with the likes of Angela Merkel and Melinda Gates.

She has a degree in electrical engineering, and an MBA.

CEO since August 2020 Brands overseen:Ford, Lincoln

Jim Farley joined Ford in 2007 to become its global head of marketing. He later moved on to be president of Ford of Europe, and then head of Lincoln, where he helped to launch the brand in China.

He took over as chief operating officer in March 2020, an appointment widely seen as making him the heir apparent to then CEO Jim Hackett.

In Farley’s time before Ford, he spent 17 years at Toyota where his roles included launching the youth-oriented Scion marque, and being the US general manager of Lexus.

Farley has a degree in political and computer science from Georgetown University, and a master of business administration from the University of California, Los Angeles.

He is also the cousin of the late Chris Farley, a comedian who was a cast member of Saturday Night Live, and starred in movies such as Billy Madison and Tommy Boy.

CEO since: 2014 Brands overseen:Peugeot, Citroen, DS, Opel, Vauxhall, Fiat/Abarth, Lancia, Alfa Romeo, Maserati, Chrysler, Dodge, Jeep, Ram.

The Lisbon-born executive joined Renault in 1981 after graduating from the Ecole Centrale in Paris.

Starting as a test driver, Tavares eventually became a program director, and led the development of the second-generation Megane.

Tavares moved over to alliance partner Nissan in 2004, rising to become head of the automaker’s American operations. He returned to Renault in 2011 to be its chief operating officer.

Widely seen as a protege of Carlos Ghosn, then-CEO of Renault and Nissan, the two fell out when Tavares told the press in 2013 he might have to move to Ford or GM in order to fulfil his ambition of being an automotive CEO. Refusing to apologise, Tavares stepped down not long after.

He joined rival French car maker PSA in 2014 and became its CEO in March that year.

PSA was in dire straits at the time, after losing around €8 billion ($13.3 billion) over the past two years, and needing a bailout from the French government and Chinese automaker Dongfeng, both of which took significant stakes in the company.

During both his tenure at Renault and PSA, Tavares has been extremely focused on cutting costs, shedding jobs in the process, and improving profit margins to around the best in the industry. He has also been keen not to chase volume over profit.

In 2017 he negotiated the purchase of Opel and Vauxhall from GM. In around a year, he turned the new divisions, which had been mired in red ink for over a decade-and-a-half, back to profitability.

Despite his laser focus on margins, Tavares is not seen as a dry accountant-type as he is a keen rally car driver.

Tavares star rose even further last year when swooped in after the proposed merger between Renault and Fiat Chrysler (FCA) fell apart.

Since the middle of January 2021 Tavares is now the head of the merged FCA-PSA entity, Stellantis.

Pitched as a “merger of equals”, the former PSA will have the whip hand as Tavares serves as CEO, and has the casting vote on a board that includes five other PSA nominees, as well as five FCA nominees.

Mike Manley, FCA’s final CEO, now heads up Stellantis USA, but is not a member of the board.

You can read more about the strong points and challenges the new automaker has in our feature “Stellantis: Everything you need to know”.

CEO since: 2018 Brands overseen:Mazda

As with many Japanese chief executives, Marumoto has spent all of his working life at one firm.

Marumoto joined Mazda back in 1980, and has worked primarily in product development and program planning.

Since joining the board of directors in 2010, Marumoto has looked after product strategy, cost control and brand enhancement.

He has overseen the company’s continued push upmarket with the latest Mazda 3, and into new technologies, such as the SkyActiv-X compression ignition petrol engine.

Under Marumoto’s leadership Mazda has also strengthened its partnership with Toyota, with the two companies jointly building a new factory in the US.

In addition to using Toyota’s hybrid systems in Japan, Mazda will also make use of Toyota’s electric vehicle technology for future products.

Mazda believes pure electric vehicles will only make up around five per cent of its total sales by 2030, with partial electrification playing a larger role in driving down CO2 emissions.

It will also use autonomous driving technology as a complement or “co-pilot” for a human driver rather than as a replacement.

CEOsince: 2018 Brands overseen:Subaru

Nakamura joined Subaru — or Fuji Heavy Industries as it was known back then — in 1982, and has worked primarily in sales, marketing and planning.

He became Subaru of America’s CEO in 2014, and saw it through a tremendous period of growth on the back of its all-wheel drive appeal – so much so he convinced headquarters to allow the American arm to produce a new three-seat crossover, the Ascent, to tackle the Toyota Kluger.

After the company admitted to tampering with fuel economy and emissions data for vehicles sold in its home market in 2018, Nakamura was promoted to the role of CEO.

The previous year the automaker had been caught using uncertified trainees to perform final inspections for vehicles being sold in Japan.

In addition to grappling with electrification and autonomous vehicle technology — problems facing all mainstream automakers — Subaru is heavily reliant on the USA, which accounts for 65 per cent of sales.

Unlike other manufacturers, Subaru has next to no presence in China as it doesn’t have a local production partner, meaning it is subject to heavy import tariffs across its entire range.

Like Mazda, Subaru is small on the global stage, and lives in Toyota’s sphere of influence, with Toyota owning a 20 per cent shareholding. The two automakers are working on a new electric vehicle platform, and a pair of crossovers — one for each brand — to ride on it.

CEO/chairman since: 1978 Brands overseen:Suzuki

Osamu Suzuki is not only the oldest chief of a large automaker, he’s also the longest-serving.

Born in 1930 as Osamu Matsuda, he married Shoko Suzuki, the granddaughter of the company’s founder, Michio Suzuki. As Michio only had daughters and granddaughters, he adopted Osamu, who then took his wife’s surname.

He joined the company in 1958, and had a number of management positions before being appointed CEO in 1978.

While most automakers have a broad range of vehicles of different sizes, and spanning a wide variety of prices, Suzuki concentrates on small vehicles, largely targeted at Japan or developing countries.

Despite selling primarily low-cost vehicles, the company has been routinely profitable through Osamu Suzuki’s relentless pursuit of cost control, including cutting the number of lights in factories or insisting employees use cheaper bullet train tickets with more stops or transfers.

Although at present he is officially only Suzuki’s chairman, his presence still looms large over the firm, and he is on-hand to make major announcements, including the company’s hybrid and model-sharing partnership with Toyota.

During his entire time at Suzuki, Osamu has forged partnerships where necessary. Firstly with GM in the 1980s to break into the European and North American markets, and then Volkswagen in 2009 to gain access to diesel and hybrid vehicle technology.

While the alliance with Volkswagen ended spectacularly, with the German company forced to sell its Suzuki shares back to the firm, one partnership stands as Suzuki’s crowning glory: Maruti Suzuki, a joint venture with the Indian government.

The first Maruti Suzukis arrived in the subcontinent in 1982, and there was initial skepticism about whether it could meet its annual sales target of 40,000 cars per year.

Suzuki’s modern design and technology, however, convinced Indians to abandon the Hindustan Ambassador, a car that began life as the 1956 Morris Oxford. Now the company controls at least 50 per cent of Indian passenger car market, which has averaged around three million annual sales over the last few years.

Osamu Suzuki has vowed to keep working until he passes away.

CEO since: 2015 Brands overseen:Honda, Acura

Hachigo started at Honda in 1982, and during his early years was involved in research and development (R&D), and chassis design.

He was in the charge of the 1999 Honda Odyssey for the North American market, which went a size up from the original and boasted a 3.5-litre V6 in order to properly battle Chrysler’s range of people movers.

His other major credit was leading the development of the second-generation CR-V.

From there he moved onto more managerial positions, including global head of R&D and purchasing, running the company’s Suzuka factory, and managing director of Honda’s Europe and China arms.

In an interview with Automotive News, Hachigo stated “EVs will not be mainstream”.

Although it is launching the retro E in Japan and Europe and a number of electric cars in China, Honda is largely focusing on hybrid technology to meet its CO2 targets. Indeed, the new Jazz in Europe will be hybrid-only.

He also believes other automakers may be too optimistic about autonomous vehicle technology. Instead of diving into a moonshot project to produce a fully self-driving car, Hachigo prefers to be “cautious”, and offer incremental and affordable improvements to customers.

CEO since: October 2020 Brands overseen:Hyundai, Kia, Genesis

In 2020 Euisun Chung became CEO of the Hyundai Motor Group, taking over from his father Chung Mong-koo, under whom he has been executive vice chairman and heir apparent since 2018.

Euisun is the grandson of Chung Ju-yung, the founder of the broader Hyundai Group.

Chung has a Bachelor of Arts from Korea University, and a Master of Business Administration from the University of San Francisco, and has been with the Hyundai Motor Group since at least 1999 when he was appointed director of procurement in the sales support division.

He jumped over to sister brand Kia in 2003, and became its president in 2005. There he was reportedly instrumental in turning around the brand. Peter Schreyer was hired as head of design during his reign.

Chung is credited with pushing through the Euro-centric Ceed range, as well as ensuring the design-first Soul was brought to market.

He rejoined Hyundai in 2009 as vice chairman, and assumed day-to-day control in 2018 when he became executive vice chairman.

CEO since: 2019 Brands overseen:Mercedes-Benz, Smart

After graduating with degrees in economics and accounting, the Swede started his career at Daimler in 1993.

He has spent almost all of his working life at the German automaker, with a two year interlude at McLaren between the 2003 and 2005, the only break.

After spending many years running Mercedes-Benz High Performance Engines, the maker of the company’s Formula 1 motors, and the AMG division, Källenius was promoted to chief of the sales and marketing, and then the research and development departments at Mercedes-Benz.

Källenius replaced Dieter Zetsche in May 2019, and is the first non-German to head up the storied automaker.

In order to bring its profit margins up, Källenius has committed to cutting costs by billions of euros, and shedding roughly 10 per cent, or 1100 people, from its management ranks.

The company’s model range, which has grown consistently over the last 20 years to about 40 models will be pruned a little bit. This will likely mean some existing models are cut to make way for electric vehicles, such as the flagship EQS sedan.

CEO since: August2019 Brands overseen:BMW, Mini, Rolls-Royce

After completing his degree in his mechanical engineering, Zipse joined BMW as a trainee in 1991.

After various roles in production, vehicle development and planning, Zipse took control Mini’s plant in Oxford, UK in 2007.

He has since led BMW’s planning and strategy departments, but his main claim to fame is on the production side where his management has lead to strong profit margins in spite of the company’s relatively small size.

Zipse became BMW’s chief after Harald Krüger decided not to run for another term citing “fatigue”.

While BMW was one of the first major automakers to adopt an electrification strategy with its innovative i3 and i8 models, it has since fallen behind the field. It’s said the BMW board is keen on reasserting itself in this segment.

CEO since: 1986 Brands overseen: Geely, Volvo, Polestar, Lynk & Co, LEVC, Lotus, Proton, Terrafugia

Li started Geely in 1986 as a fridge manufacturer, before moving on to motorcycles in 1993. The company made its first car around the turn of the millennium using Daihatsu Charade underpinnings.

Geely is one of the few automakers in China not to be formed from a state-owned company or rely on a forced partnership with an overseas carmaker.

Widely seen as a local success story, more than a few of its early vehicles had styling which bore an uncanny resemblance to other vehicles.

The company began to be taken seriously outside of China when it bought Volvo Cars from Ford in 2010 for US$1.8 billion ($2.8 billion).

It wasn’t Geely’s first overseas acquisition — that honour goes to the maker of London’s famous black taxi cabs in 2009 — and it wouldn’t be its last. In 2017 Geely took a 51 per cent stake in British sports car maker Lotus, and a 49 per cent shareholding in Proton.

More astonishingly, Li bought an almost 10 per cent stake in Daimler, the parent of Mercedes-Benz, in 2018 in a bid to force the two automakers into a technology partnership.

While the two have started some projects together in China, their first major collaboration involves Geely buying a 50 per cent stake in Daimler’s Smart brand.

This will see global production for next generation of Smart vehicles shift from France to China. For these cars Geely is in charge of engineering, while Daimler will do the design.

Previously Geely has tapped into the resources at Volvo to help it engineer new platforms and make its designs more appealing to audiences outside of China.

The company is now in the process of merging its operations with Volvo in order to cut costs and improve development times.

Forbes estimates Li is worth around US$13.4 billion ($20.6 billion).

CEO since: 2016 Brands overseen: Tata, Jaguar, Land Rover, Range Rover

Before joining Tata, Butschek was chief operating officer at airplane maker Airbus for two years. Prior to this he spent 25 years at Daimler working across procurement and production.

Tata Motors has traditionally given Jaguar Land Rover (JLR), its UK luxury subsidiary, a lot of autonomy.

Jaguar Land Rover is currently helmed by Ralf Speth. Born in Germany, Speth was a business consultant before joining BMW in 1980. He stayed at the Bavarian automaker for 20 years, and finished up there as the head of the Land Rover brand.

Afterwards he spent a few years as head of global operations at the Linde Group, a gas, chemicals and engineering multinational. He returned to the auto industry with Ford Premier Automotive Group, and was transferred to Jaguar Land Rover when the British firm was sold to Tata in 2008.

Speth took over as JLR’s CEO in 2010, and during his reign the company had many years of growth in terms of sales, profits, range and personnel. The brands now cover more market segments, with Jaguar, most significantly, now offering crossovers as well.

That all came to a screeching halt when economic and quality control problems in China, as well as Brexit uncertainty and the growing unpopularity of diesel engines, saw the firm lose £3.6 billion ($6.8 billion) in the 2018-2019 financial year.

Prior to the COVID-19 pandemic, the company was back in the black due to some savage cost cutting and redundancies.

At the beginning of the year Speth announced he was going to step down from running the automaker on a daily basis in September. Reports indicate the Tata board want him to stay a longer due to the coronavirus pandemic and its after effects.

Probably due to the wide gap between the markets the Tata marque and Jaguar Land Rover are chasing, there has been little scope for technology transfer between the company’s two arms.

Although the Tata Harrier/Buzzard, which was released in 2019 and is based on same platform as the Range Rover Evoque, could be a sign of things to come.

Derek Fung would love to tell you about his multiple degrees, but he's too busy writing up some news right now. In his spare time Derek loves chasing automotive rabbits down the hole. Based in New York, New York, Derek loves to travel and is very much a window not an aisle person.

James Wong

5 Days Ago

James Wong

4 Days Ago

Max Davies

3 Days Ago

Josh Nevett

2 Days Ago

Max Davies

2 Days Ago

James Wong

17 Hours Ago