Matt Campbell

2025 Toyota Yaris Cross review

4 Days Ago

Contributor

Renault has unveiled a new plan to move its focus “from volume to value”.

Renault CEO Luca de Meo has tonight outlined his plan to step away from its “immoderate quest for volume” and “unresolved approach to market and brand portfolio management”.

The brand will pull back from its plan to sell five million cars worldwide by 2022, and instead focus on developing and manufacturing cars more efficiently in search of greater profit.

The plan has been broken down into three parts:

It’s not yet clear what impact the new business plan will have on Renault in Australia. The company last year laid out its plan for our market, which saw the Clio and Zoe axed from local plans and the Kadjar following them out the door.

In the short term, Renault will look to be more efficient with its model range. The brand’s global range is currently made up of 40 per cent region-specific models, which are more expensive to develop because they require unique parts and supply chains.

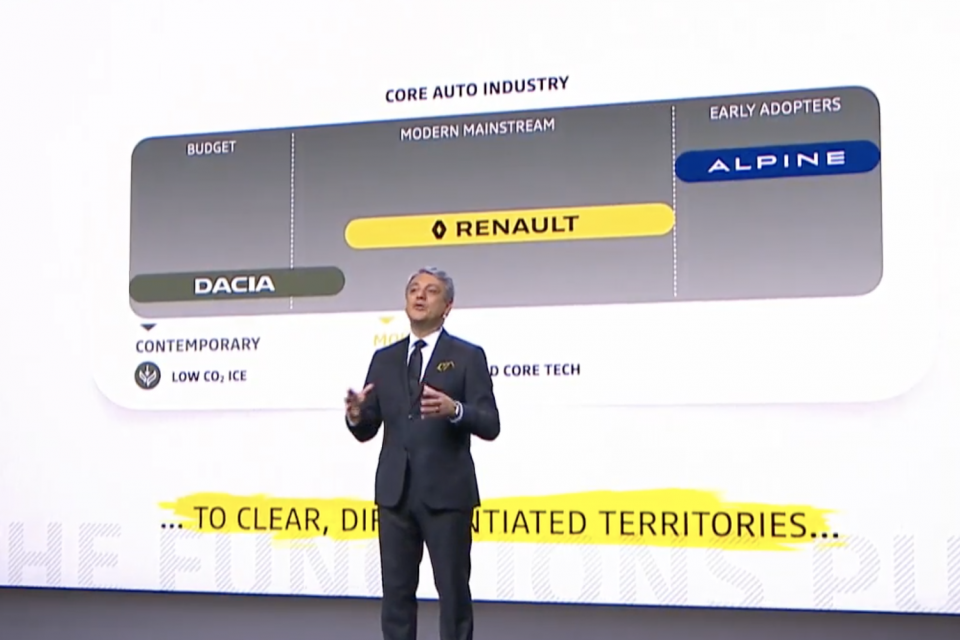

It will also look to reduce overlap between its budget Dacia brand and mainstream Renault brand, which sell cars in the same segments at similar price points.

Before 2023 the brand plans to cut the number of global platforms it uses from six to just three shared across the Renault-Nissan-Mitsubishi Alliance: the CMF-B platform, which also supports electric vehicles, as well as CMF-C/D and the dedicated electric CMF-EV platform.

Renault will also cut the number of engine families from eight to just four in response to the rising costs associated with meeting tough new European emissions standards.

“We’ll have fewer powertrains, equipped in more vehicles, and spanning a wider horsepower coverage,” Mr de Meo said.

Combined with hybrid power, Renault plans to use just one petrol engine family across its entire range. It will also have one diesel engine family, alongside hydrogen and pure-electric powertrains.

Rather than having the manufacturing footprint to build more than four million cars annually, Renault will instead focus on making 3.1 million cars per year by 2025.

Renault will make an effort to focus more heavily on Latin America, India, and Korea, which it argues are more profitable.

It will also aim to build on previous success in Spain, Morocco, Romania and Turkey.

A glut of new product will come as a part of the new strategic plan. All models built on updated or existing platforms will be released within three years, and Renault is planning 24 new car launches by 2025 across its Dacia, Renault, Alpine, and New Mobility brands.

Half of those cars will be in the C and D segments.

The brands under the Renault umbrella will be split up in the following way:

“We’ve streamlined our operations starting with engineering, adjusting our size when required, reallocating our resources in high-potential products and technologies,” Luca de Meo said in a statement.

“This boosted efficiency will fuel our future line-up: tech-infused, electrified and competitive. And this will feed our brands’ strength, each with their own clear, differentiated territories; responsible for their profitability and customer satisfaction.

“We’ll move from a car company working with tech to a tech company working with cars, making at least 20 per cent of its revenues from services, data and energy trading by 2030.”

CarExpert helps new car buyers save thousands with expert reviews, honest advice, and transparent pricing – no dealer pressure and no sales games.

Scott Collie is an automotive journalist based in Melbourne, Australia. Scott studied journalism at RMIT University and, after a lifelong obsession with everything automotive, started covering the car industry shortly afterwards. He has a passion for travel, and is an avid Melbourne Demons supporter.

Matt Campbell

4 Days Ago

William Stopford

3 Days Ago

Josh Nevett

1 Day Ago

James Wong

1 Day Ago

Max Davies

1 Day Ago

Damion Smy

15 Hours Ago