Derek Fung

Renault Duster ute revealed with a tiny tray

1 Hour Ago

Renault puts majority of its stake in Nissan into a French trust and neutralises some voting rights, to restore the balance.

Contributor

Contributor

After more than a year of discussions, Renault and Nissan will equalise aspects of their cross-shareholding Alliance agreement, to strengthen the partnership in a changing environment.

The Alliance changes take a three-stage approach that involves collaborative operational projects across key markets, new strategic initiatives such as EV investment, and a reformed governance structure that reduces inequalities.

The major outcome revealed in the plans for a renewed Alliance is the change in corporate shares, with Nissan and Renault Group to have equal 15 per cent cross-shareholdings.

This is a clear change from the previous stature, where the Renault Group held nearly 44 per cent of Nissan shares, while Nissan held only 15 per cent of Renault Group shares.

The 15 per cent shares will come attached with lock-up and standstill obligations for both parties, which mitigate how and when a party can sell company shares.

Additionally, both parties will have voting rights attached to their shares, as opposed to the current agreement where Nissan’s shares have no voting rights attached, an obvious point of contention in the previously lopsided agreement.

To arrive at the equal 15 per cent shares, the Renault Group will have to reduce its shares in Nissan by 28.4 per cent, which it will do by transferring the shares into a French trust, meaning it will retain the economic rights of the shares but voting rights will be ‘neutralised’.

The proposed French trust would be instructed by the Renault Group to sell its Nissan shares should it be ‘commercially reasonable’, but it would be under no obligation to do so in line with a particular time frame.

Considering Nissan has become substantially more profitable since the inception of the Alliance, it seems that the Renault Group is protecting the economic value of its shares while moving forward with a more balanced agreement to placate stakeholders.

Joint press releases from both automakers detail the ‘high-value-creation operational projects’ which will form part of the newly balanced Alliance.

The automakers have been tight-lipped on the details of said projects, only revealing that they will be “deployed along three dimensions: markets, vehicles and technologies,” and launched in Latin America, India, and Europe.

The new agreement also details that Nissan will invest in Ampere, the EV venture founded by the Renault Group, with the ambition of becoming a strategic stakeholder in the company.

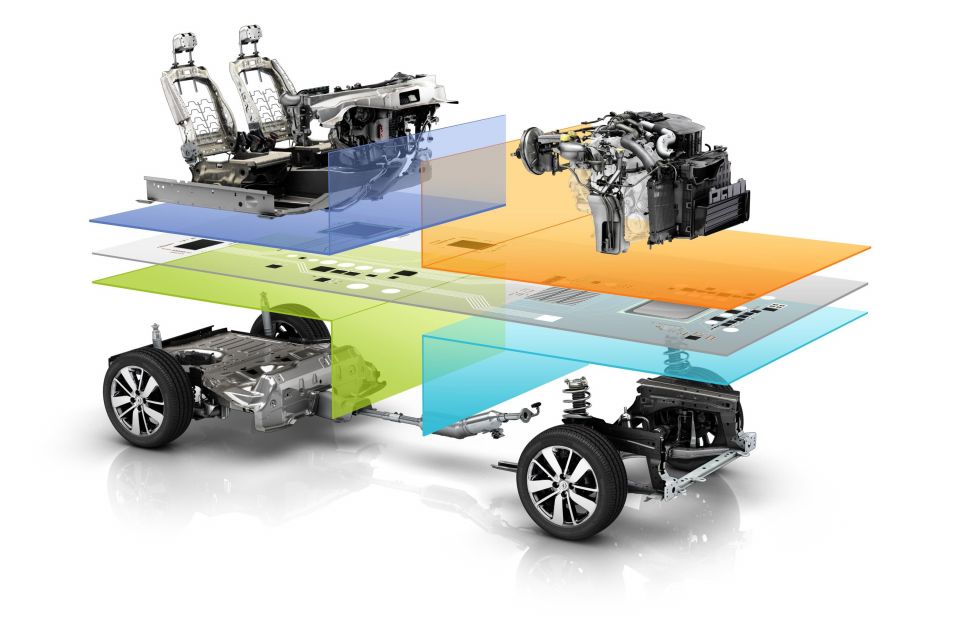

Ampere is Renault’s EV wing that will develop, manufacture, and sell electric passenger cars, with a scheduled line-up of six Renault-badged EVs by 2030.

Nissan’s investment in Ampere would allow Nissan, and its partner Mitsubishi Motors, to use the hardware and software technologies in its future EV models.

The new foundations of the Alliance are dependent on approval from a board of directors of Renault Group and Nissan, and once finalised will be announced immediately.

Speculated points of contention have included disagreements concerning intellectual property rights, and a breakdown of trust and communication after former Alliance head Carlos Ghosn was arrested for financial misconduct in 2018.

If approved, the reforms will be the first major change to the Alliance since its inception in 1999, when Renault saved Nissan by taking a controlling stake during a period of financial struggle.

The automakers said that the changes have been proposed with the ambition to “strengthen the ties of the Alliance and maximise value creation for all stakeholders”.

Derek Fung

1 Hour Ago

William Stopford

8 Hours Ago

Max Davies

15 Hours Ago

Max Davies

15 Hours Ago

Ben Zachariah

16 Hours Ago

William Stopford

16 Hours Ago