James Wong

2026 Audi Q5 review: Quick drive

6 Days Ago

A report into Australia's nascent EV market shows dominance of private buyers and Chinese factories. And check out the ACT's uptake...

Senior Contributor

Senior Contributor

The majority of electric vehicles sold in Australia during 2022 came from China and were bought by private buyers, while the ACT continues to outpace all other states and territories when it comes to EV uptake.

These are some take-aways from a summary of Australia’s low-emissions market issued by car brand peak body, the Federal Chamber of Automotive Industries (FCAI), using its VFACTS sales data.

These promised quarterly reports appear to be a riposte to the Electric Vehicle Council, which has made inroads as the advocacy group for EV take-up, and for spurring policy decisions.

Australians took delivery of 33,410 battery electric vehicles in 2022, which was sixfold year-on-year (YoY) growth on paper – offset by the fact that Tesla only started publishing local sales figures last year, skewing the data.

That equates to market share of around 3 per cent, with a growth trajectory pointing to a much higher figure in 2023 – the EV share sits north of 6 per cent to the end of February 2023.

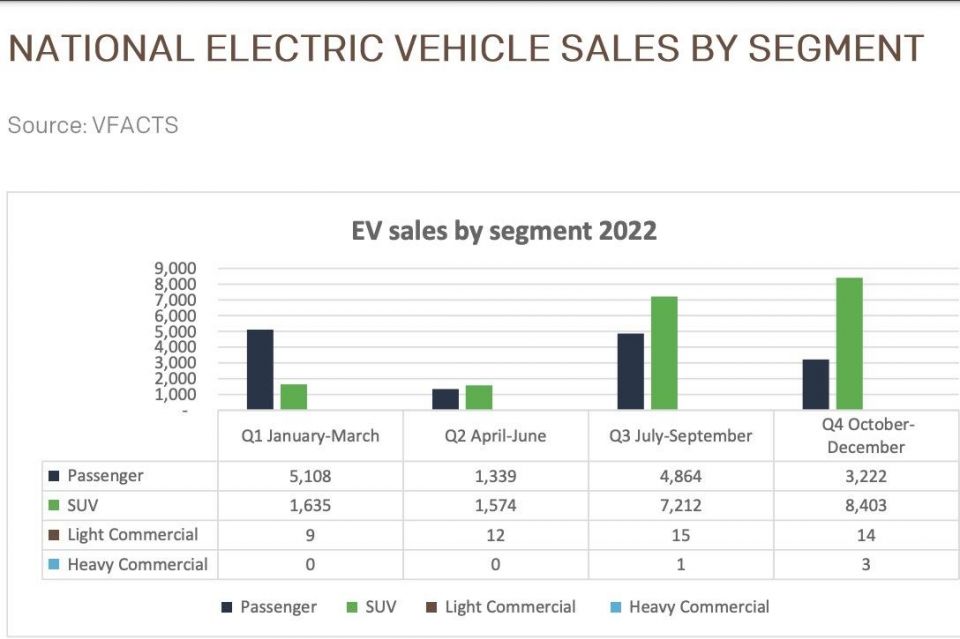

Over the course of 2022 we saw the EV market increasingly favour crossover SUV body styles over traditional passenger cars, much of which coincided with the launch of the long-awaited Tesla Model Y around mid-year and the BYD Atto 3 a few months after.

“This is consistent with other markets across the world. The availability of battery electric models within the market preferred light commercial and heavy commercial segments remains limited and is likely to remain that way throughout the current model cycles,” the FCAI adds – though we’d add there are a number of electric vans here or coming this year.

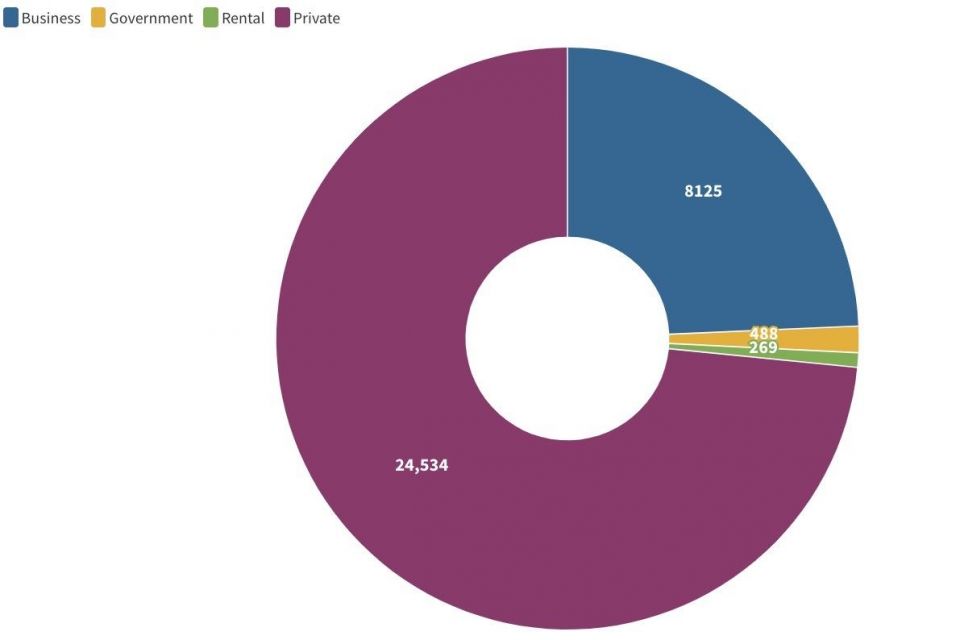

Crucially, the summary also notes that EV take-up is still dominated by the private market rather than fleets, clearly indicating that the government’s fringe-benefits tax cuts for businesses buying battery-powered vehicles was a sensible move to grow the parc.

EV sales by buyer type in 2022

All told 80 about per cent of EVs sold here in 2022 were made in China, which is a point of note for those who focus on geopolitics.

All Teslas sold here come out of Giga Shanghai, while other top-sellers such as the BYD Atto 3, Polestar 2 and MG ZS EV are made there as well. China dominates the global EV chain, although Europe and the US are working on ways to change this through policy levers.

EV sales by source country in 2022

EV sales by region

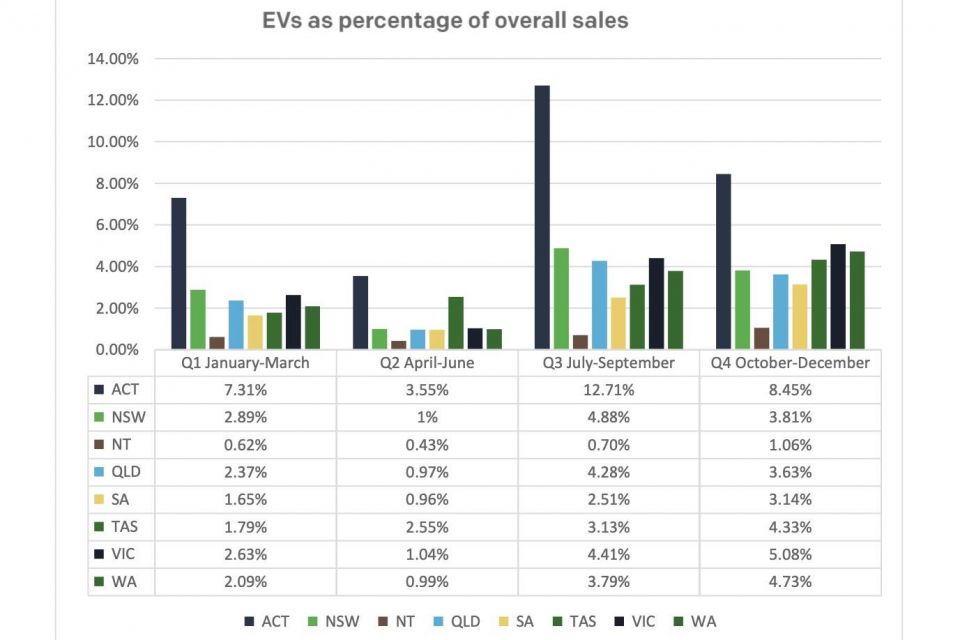

One of the more interesting take-aways is the difference in EV take-up across the states and territories, all of which offer some form of subsidy or tax relief for EV buyers.

The Northern Territory is an outlier in the sense EVs are nearly non-existent up there, whereas in the ACT the market share of EVs was 8.0 per cent. The ACT government offers EV buyers stamp duty waivers, free registration and zero-interest loans to drive uptake.

EV sales and share by region

Top 10 EV brands in 2022

Top 10 EV models by sales in 2022

James Wong

6 Days Ago

James Wong

5 Days Ago

Max Davies

4 Days Ago

Josh Nevett

2 Days Ago

Max Davies

2 Days Ago

William Stopford

1 Day Ago