James Wong

2025 Audi A5 Sedan TFSI 150kW review

4 Days Ago

News Editor

The past 25 years have been eventful in the Australian new car market, with plenty of manufacturers coming but plenty going too.

Some have rebranded – Great Wall has become GWM, for example, while Maybach is now Mercedes-Maybach. Skoda and LDV have entered the market and surged. Others like MG and Renault have had another crack and proved more successful this time around.

Some companies, however, have been less successful.

They’ve entered the Australian market seeking to expand their global presence, only to face the harsh realities of competing in a market brimming with options. Or worse yet, their global operations have become imperilled, dooming their Australian presence.

These are some of those brands.

Missed last week’s Part 1? 25 years of failures: The car brands that didn’t succeed in Australia, Part I

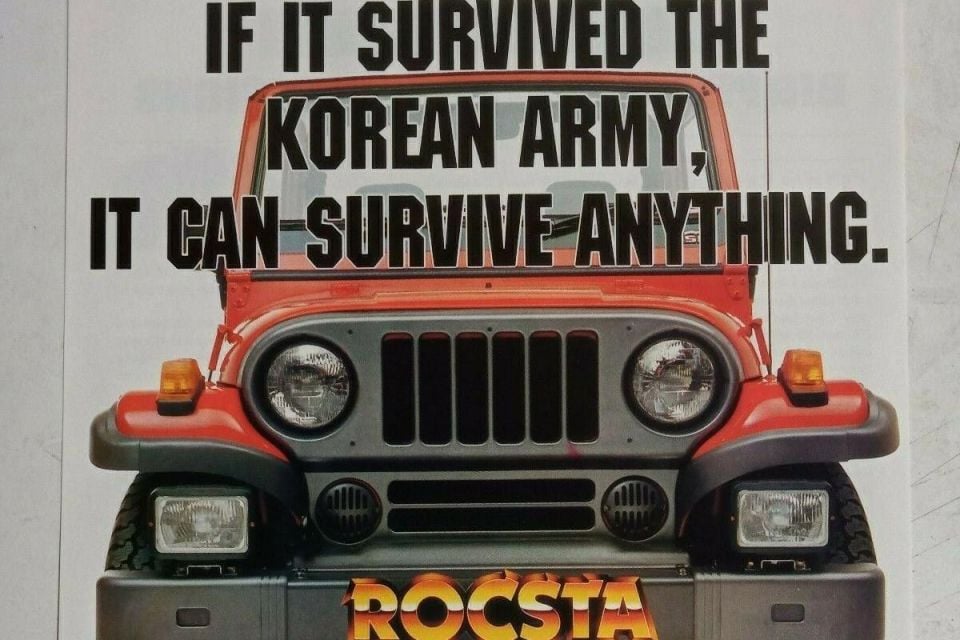

Years sold: 1993-2000 Models sold: Rocsta

We fudged the cut-off for Part 1 of this article to squeeze in Eunos, which arrived just over 25 years ago, so we have to afford the same luxury to Asia Motors. That’s ironic as this is anything but a luxury brand, and perhaps a polar opposite to Eunos.

The Korean company arrived in Australia after Hyundai but before Kia, Daewoo and SsangYong. A subsidiary of Kia at the time, Asia Motors manufactured small 4x4s for the Korean military.

The Rocsta was the only model introduced to Australia, resembling a shrunken Jeep Wrangler and targeting the likes of the Lada Niva, Suzuki Sierra and Daihatsu Feroza.

It was offered with either a naturally-aspirated 1.8-litre petrol four-cylinder with 63kW of power and 131Nm of torque, or a naturally-aspirated 2.2-litre diesel four with 53kW and 142Nm. Only a five-speed manual was available.

A Sydney dealer named I & B Campbell managed to secure the rights to sell the Rocsta in Australia, outmanoeuvring the likes of larger distributors like Inchcape, and the Rocsta was eventually available through a network of dozens of dealers, including in Tasmania and the Northern Territory.

But the Rocsta was destined to be a low-volume affair despite its sub-$20,000 starting price – 118 were sold in 1993, the only year the rugged off-roader cracked three digits. Nevertheless, the Rocsta held on until 2000 when imports finally ceased.

According to VFACTS, only 375 were sold over its run.

Years sold: 1995-99 Models sold: Ibiza, Cordoba, Toledo

The Volkswagen Group clearly took some learnings from its disastrous attempt at selling the Seat brand here in the 1990s when it introduced Skoda in the 2000s, which bodes well for its imminent introduction of Cupra.

If Skoda has shown how to successfully operate a mainstream European brand in Australia, Seat showed how such an operation could be completely bungled.

During the mid-1990s, Japanese car prices had been rising due to unfavourable exchange rates, which left an opening for challengers. It was something the Koreans deftly exploited but Seat couldn’t – despite its promise of combining “exacting German engineering with unbridled Spanish passion”.

The Spanish brand arrived in 1995 with a three-model range: the Ibiza light hatch and its small Cordoba sedan sibling, as well as the mid-sized Toledo hatch.

These were sold through a network of 29 dealers that also handled the Volkswagen brand, and were pitched at younger car buyers “looking for style and performance but who seem to have been largely abandoned by Asian carmakers”.

Although it was positioned as more of a budget brand than Volkswagen, Seat couldn’t quite match the insurgent Koreans on price. The base Ibiza CLX hatchback, for example, cost around $1500-2000 more than similarly-equipped but typically more powerful Korean models, which wasn’t ideal in the price-conscious light car segment.

Sharing a platform with the Volkswagen Polo, it used a naturally-aspirated 1.4-litre four-cylinder engine with 44kW of power and 107Nm of torque, paired with a five-speed manual. While a manual was best-suited to making the most of those low outputs, the lack of an auto stood out in a segment where such an option was increasingly popular.

Less surprising was the absence of an auto in the sprightly GTi, which cost around $10,000 more but packed a spunky 85kW/166Nm single-cam 2.0-litre four.

The Cordoba was better value. Effectively an Ibiza with a big boot and a more powerful 66kW/145Nm 1.8-litre, it had a fairly tight back seat but plenty of luggage space and straddled the hatchback-dominated light car and more sedan-friendly small car segments.

With a base price of just under $22,000, it was pricier than entry-level sedan versions of the Hyundai Excel but undercut the Mitsubishi Lancer, putting it up against left-field Japanese models like the Daihatsu Applause and Suzuki Baleno.

The Toledo was the largest and priciest model but it was also the oldest. Sliding in just under $30,000, the Toledo was a hatchback styled to look like a sedan. It had been introduced in Europe back in 1991 and its underpinnings dated back to the Volkswagen Golf Mk2.

The Australian-market GLX shared its 85kW/166Nm 2.0-litre four with the Golf GTi and Ibiza GTi, while a 16-valve version put out 110kW and 180Nm but cost several thousand dollars more.

All Seat models featured a three-year, 60,000km warranty and a 24-hour roadside assistance package, which was fairly decent for this era. Alas, the new brand just didn’t resonate with Australian buyers.

Consider this: Daewoo, another challenger brand that entered Australia at almost exactly the same time as Seat, sold 4145 cars in 1995 and would sell considerably more in 1996. Seat, in contrast, sold 1859 vehicles in its debut year, sliding to 975 in 1996.

By 1997, the brand had virtually collapsed. The Ibiza had slid from 778 sales to 239 in 1996, but Seat sold just four examples in 1997 as stock dried up; likewise, it shifted four Toledos. The company sold 358 Cordobas, but that was paltry – even Proton sold 934 Personas that year.

Distributor Inchcape said at launch it hoped to be selling around 5000 cars annually by the end of the 1990s. But by 1998, the Seat brand entered a period of hibernation. Its network of 31 dealers winnowed away to just 10 as the brand prepared for a relaunch late in 1998.

For 1999, the Cordoba saw its base price slashed by $5500 with the introduction of a new SE model with a smaller 55kW/125Nm 1.6-litre four. The equipment list was slashed, with power windows, central locking and even dual airbags removed, though power steering remained.

The GLX was replaced by a new SXE trim, which offered a new 74kW/140Nm 1.6-litre engine when fitted with a stickshift.

The Ibiza was now available only in hot twin-cam 110kW/180Nm Cupra guise, which meant it continued to be a rare hot option in the light car segment. The Toledo received the mildest of facelifts and its 16V version was axed, with a new Magnus trim the only option.

At its relaunch, Seat projected 1600 sales in 1999: 250 Toledos, 240 Ibizas and 1110 Cordobas. But in July 1999, distributor Inchcape announced it would relinquish the Seat franchise from November 30.

In a press release, it announced “the onset of the Asian currency crisis coupled with a number of other obstacles has resulted in the Seat business not achieving expected sales levels or financial targets”.

Seat fell woefully short of its target for 1999, with just 266 sales. In all, Seat had sold 3561 vehicles over its interrupted run in Australia: 2117 Cordobas, 1106 Ibizas, and 338 Toledos.

Despite an initially strong marketing presence, the brand had let itself disappear from the public consciousness and then let its products disappear from its own showrooms. Inchcape’s dropping of Seat in 1999 was a mercy killing, as the vaunted relaunch showed no signs of bearing fruit.

Sadly, Australia would end up missing out on models like the second-generation Toledo and related Leon hatchback, which spearheaded a design renaissance for the brand. Gone were the slab-sided designs dating back to the early 1990s, replaced with curvaceous designs from Giorgetto Giugario (Seat would later switch to designs by Walter de Silva that were an acquired taste).

Today’s Seats have a crisper, more Germanic look but are handsome vehicles, and we’ll be getting two of them – the Leon and Ateca – in spicier Cupra form in 2022.

Years sold: 2001-05 Models sold: 75

The Rover brand had last been seen in Australia in 1991, when its importer JRA Limited ceased to exist. Rover Australia Pty Ltd was formed as a wholly owned subsidiary of the Rover Group, but it opted to import only Land Rover and Range Rover products due to unfavourable exchange rates and an increased Luxury Car Tax.

By 1991, Rover was only selling the 800, with the Honda Integra-based 416i out of production and plans to import the British-built, Honda-based 200 and 400 scuttled largely due to unfavourable exchange rates.

Rover had continued to exist in other markets with a line-up of predominantly Honda-based models, and was purchased by BMW in 1994. Despite heavy investment, Rover’s lack of profitability led BMW to sell the brand in 2000, just a year after European deliveries first began for the new 75.

BMW CEO Bernd Peter Pischetsrieder had actually publicly undermined the future of his acquired brand at the 75’s motor show reveal in 1998, abruptly mentioning actions needed to be taken for the “long-term future of the Rover Group” and calling for talks with the UK government about “the whole problem”.

Books have been written about the collapse of Rover, but let’s focus on its Australian presence.

The 75 was the only Rover developed under BMW ownership. While BMW had planned to import the Rover 75 here, the sale of the brand put an end to that.

Instead, a newly formed company called MG Rover Australia took the baton and introduced the 75 sedan in 2001, followed shortly thereafter by the 75 Tourer wagon. Pricing started in the low-$50,000s, putting it up against Europeans like the Alfa Romeo 156, Peugeot 406 and Volvo S40/V40.

The 75 rode a new front-wheel drive platform, unlike the 600 and 800 it replaced that were related to the Honda Accord and Legend, respectively. There was some BMW influence under the skin, however, with the 75 using BMW’s Z-axle rear suspension as seen in the 3 Series.

There was certainly no BMW influence visually – the exterior was curvaceous and adorned with chrome, while the clubby if somewhat cramped cabin was awash with wood and leather.

Australian-market models were powered by a naturally-aspirated 2.5-litre V6, producing 130kW and 240Nm and available with a five-speed manual or five-speed automatic transmission.

In 2002, the 75 range was joined by the related MG ZT and ZT-T, with retuned suspension, slightly more power, and more aggressive styling inside and out. For decades, MG had produced sportier versions of its corporate cousin brands’ mainstream hatchbacks and sedans, so there was precedent here.

While the ageing, Honda-based Rover 25 and 45 didn’t make the trip, their sportier MG ZR and ZS cousins did. A facelifted 75 and ZT range with less overtly retro-looking styling arrived in 2004, which coincided with the introduction of a turbo-diesel option for Australia.

Even more excitingly, the MG ZT 260 arrived Down Under. This was a version of the ZT re-engineered for rear-wheel drive and fitted with Ford’s single overhead-cam Modular 4.6-litre V8 engine producing 191kW of power and 410Nm of torque, mated with a Tremec-sourced five-speed manual; a more luxury-focused Rover 75 V8 was also sold overseas.

The RWD V8 exercise was undoubtedly cool but seemed a poor use of money and resources for ailing MG Rover. At $89,990, the ZT 260 was also around $20,000 more expensive than the next priciest ZT, the recently introduced ZT 220S, which used a 165kW/288Nm supercharged version of Rover’s 2.5-litre V6.

Sadly, the new variants arrived too late. Though the Phoenix Consortium that had bought MG and Rover from BMW had done a decent job expanding the model line-up, its losses had caught up with it.

A proposed joint-venture with Chinese SAIC Motor fell through (though it did get the rights to a lot of MG Rover intellectual property) and MG Rover went into administration. MG Rover Australia also went into voluntary administration with 18 dealers now left without the British brands.

185 mostly brand new vehicles were auctioned en masse. That included examples of the three- and five-door ZR 160 hatchback, which had only just been introduced. This version of the Rover 25, which dated back to 1995, packed a naturally-aspirated 1.8-litre four-cylinder engine with 118kW and 174Nm.

The ZS sedan, also based on a 1995-vintage Rover (and, in turn, the 1992 Honda Domani), was introduced in 2004 and used a naturally-aspirated 2.5-litre V6 with 133kW and 240Nm. Both models, being enthusiast-focused, were available only with a five-speed manual.

In the 75’s first year, MG Rover Australia sold 740 examples, falling short of a 1000-vehicle target; the MG ZT’s best year had been 2003, with 168 sold. All up, the company sold 1856 75s and 455 ZTs. The short-lived ZR and ZS were even rarer – just 15 ZRs were sold along with 41 ZSs.

While the MG brand departed the Australian market at the same time as Rover, its new Chinese owner – SAIC Motor did eventually acquire the brand – reintroduced it here the following decade.

The hot hatches and luxurious sports sedans and wagons have made way for crossovers and an ageing light hatch, but the brand has finally achieved mainstream success.

The Rover brand has never again seen the light of day – the rights to use the name now belong to Jaguar Land Rover owner Tata, though SAIC Motor’s more upscale Roewe brand is Rover’s natural successor.

Years sold: 1996-2005, 2013-2019 Models sold: Safari, Xenon, Telcoline

Tata has had two attempts at the Australian market in the past 25 years under two different distributors.

In 1996, Queensland-based Anoger Automobiles brought the Indian brand here and offered the Telcoline, not a telecommunications company but rather a generic-looking ute.

The Telcoline was one of Australia’s cheapest utes, starting at under $20,000, though it was one of the oldest having first been introduced in India in 1988.

It was powered by a 50kW/118Nm 2.0-litre naturally-aspirated diesel engine sourced from Peugeot, though this was eventually supplanted by a turbo-diesel with 67kW and 191Nm. Only a five-speed manual was available, though the Telcoline offered two- and four-door ute and cab-chassis body styles.

The awkward-looking Safari SUV followed in 2000, by which point Tata had around 50 dealerships and claimed an average of 600 ute sales annually. As it never joined the Federal Chamber of Automotive Industries, official sales figures weren’t published in monthly VFACTS reports.

The Safari used the Telcoline’s turbo-diesel and was also available only with a manual, though this model was aimed at rural buyers. Initially priced under $30,000, this wasn’t cheap enough for a dated, indifferently assembled SUV, even if it did have some vague semblance of off-road ability.

UK publication Total Off-Road summed up the Safari thusly: “It’s just a horrible, horrible thing, and under no circumstances should you ever buy one. It fails to deliver on any of its promises, implicit or explicit.”

Tata quietly left the Australian market around 2005, but returned in 2013. Now distributed by Walkinshaw-owned Fusion Automotive, the brand sold just one vehicle: the successor to the Telcoline, known here as the Xenon.

This was a rival to other budget utes like its countryman the Mahindra Pik-Up, as well as the Foton Tunland and Great Wall V240. By 2014, the distributor said there were 35 Tata dealers and more on the way, though again its sales figures weren’t reported in VFACTS.

It initially received a disappointing two-star rating from ANCAP, largely due to the absence of stability control. When this was added, the dual-cab was retested and received four stars which was better than its budget rivals.

The range comprised two- and four-door models, with ute and cab-chassis body styles and a choice of rear- or four-wheel drive, all powered by a 110kW/320Nm 2.2-litre turbo-diesel. Pricing sat between the skinflint Great Wall utes and the established Japanese competition, though the lack of an automatic transmission undoubtedly hurt the Xenon.

It took until 2017 for a six-speed auto to join the five-speed manual. But the Xenon failed to resonate with Australian buyers even as other budget utes like the LDV T60 surged. Local sales drew to a close in 2019.

Years sold: 2006-2016 Models sold: Caliber, Avenger, Journey, Nitro

Dodge had never been much of a global brand. Models like the Shadow and Neon were exported from the US wearing Chrysler badges, while even in Canada the brand’s passenger cars were rebadged as Chryslers in the 1990s and 2000s.

The Dodge name had last been seen in Australia on an entry-level version of the VK Valiant ute in 1976.

In the 2000s, the Chrysler and Dodge brands had been given aggressive new design languages. Gone were the swoopy, cab forward designs of the 1990s, and in were models like the Chrysler 300 with blocky, unashamedly American styling.

In the dying days of the DaimlerChrysler “merger of equals”, Dodge was given a global push with the Neon-replacing Caliber and the Nitro SUV debuting at the 2006 Geneva motor show.

The brand was introduced in China, Japan, Europe, New Zealand and Australia, with the small Caliber hatchback launching locally in 2006 and the mid-sized Nitro, a cousin to the Jeep Cherokee, following in 2007.

The range was rounded out by the Avenger later in 2007, a more muscular looking version of the dorky Chrysler Sebring also introduced Down Under, and the more subtly styled Journey crossover in 2008.

The Caliber was rather ahead of its time in offering SUV-like styling in a segment otherwise dominated by more milquetoast hatchback and sedan body styles. But styling aside, none of the new Dodge products were particularly good.

The Caliber, Avenger and Nitro were all beset with the plastic fantastic interiors Chrysler was peddling at the time, while the Journey’s cabin was only marginally better. Dodges were also known for hard, unsupportive seats and poor visibility.

The four-cylinder petrol powertrains in the Caliber and Avenger were noisy and underwhelming, while the petrol V6s in the Nitro and Avenger were far from class-best and we missed out on the more powerful V6s they offered in the US.

None of the vehicles could be described as having engaging handling, either, while the Nitro lacked much of the Cherokee’s off-road ability and yet still drove like a truck on the road.

Pricing didn’t dramatically undercut scores of superior, established rivals, exemplified by the Avenger which in weedy SX manual base trim cost the same as an entry-level Toyota Camry. Dodge products did at least boast some unique features, however, which depending on the model included heated/cooled cupholders, tailgate-mounted speakers, and stain-resistant seat fabric.

As Dodge had been introduced in Europe, every model was available with a diesel powertrain: a Volkswagen-sourced 103kW/310Nm 2.0-litre four in the Caliber, Avenger and Journey and a 130kW/460Nm VM Motori 2.8-litre in the Nitro. All bar the diesel Caliber came with an automatic transmission, with the Avenger and Journey using a six-speed ‘DSG’ dual-clutch auto.

To Dodge’s credit, it improved the Caliber’s interior somewhat in 2010, trimming the range to one variant in the process and later slashing the price. The Journey received an interior gut remodel in 2012 that coincided with a facelift and, crucially, a more powerful engine.

The Volkswagen-sourced turbo-diesel was dropped, and the 138kW/256Nm 2.7-litre petrol V6 was replaced with Chrysler’s new Pentastar V6 with 206kW and 342Nm. Despite the massive upgrade in power, combined cycle fuel consumption was only 0.1L/100km higher.

The Journey had proved to be the most impressive of the Dodge line-up with its smartly packaged interior. By 2012, it was the only Dodge remaining.

Dodge’s small car reverted to being a sedan in 2013, with the Caliber making way for the Dart. Alas, it wasn’t engineered for right-hand drive. The Avenger had received a mid-cycle update similarly extensive to that of the Journey for 2011 but it didn’t come here, Chrysler Australia axing it and its Sebring cousin in 2010. The Nitro was also axed globally without replacement late in 2011.

Dodge soldiered on with its one-model line-up, with Journey sales remaining fairly steady. Dodges were always sold in dealers alongside Chryslers and Jeeps, so the brand hardly needed a full model line.

A badge-engineered twin, the Fiat Freemont, was introduced in Australia in 2013 with a 2.4-litre petrol four and a Fiat-sourced 2.0-litre turbo-diesel, though shortly thereafter it gained the Journey’s petrol V6 as if to undermine the sole surviving Dodge. The two crossovers were neck-and-neck in sales, if behind class leaders.

Frustratingly, despite the availability of a right-hand drive Chrysler 300, the company never engineered a right-hook Dodge Charger or Challenger.

The latter, for example, could have really resonated with the Australian public and beaten the right-hand drive Ford Mustang to market. It also would have burnished Dodge’s reputation as a purveyor of performance vehicles. Alas, we didn’t even receive models like the turbocharged 213kW Caliber SRT-4.

Fiat Chrysler Australia finally pulled the plug on the Dodge brand in 2016, with rumblings about a right-hook version of the large Durango SUV, Charger and Challenger never leading anywhere.

In all, Dodge sold 18,595 vehicles between 2006 and 2017 – 9184 Journeys, 4379 Nitros, 4250 Calibers, and a paltry 782 Avengers.

In the years in which it had more than one product, it averaged around 2200 sales; its best year was 2011, with 2703 sales recorded – ahead of Citroen and Fiat, but behind Renault and Skoda. Every model bar the Avenger cracked 1000 annual sales at least once, with the best year for a Dodge being 2013 with 1661 Journeys sold.

All five of these brands failed but for entirely different reasons. Tata didn’t have the right product at the right price, while Dodge was hamstrung by the lack of desirable right-hand drive options.

Rover went bust even though its sole model was decent, while Seat’s brief run in Australia was almost a comedy of errors – how often is a new brand introduced and then put into stasis after just two years?

In the next instalment, we’ll look at more brands that have failed over the past 25 years...

CarExpert helps new car buyers save thousands with expert reviews, honest advice, and transparent pricing – no dealer pressure and no sales games.

William Stopford is an automotive journalist based in Brisbane, Australia. William is a Business/Journalism graduate from the Queensland University of Technology who loves to travel, briefly lived in the US, and has a particular interest in the American car industry.

James Wong

4 Days Ago

Matt Campbell

3 Days Ago

William Stopford

2 Days Ago

Marton Pettendy

15 Hours Ago

Josh Nevett

15 Hours Ago

James Wong

15 Hours Ago