I’ve owned Teslas now (among other cars) for around five years.

First up was a Model 3 Performance for two to three years and then this time around it was a base Model Y (on a novated lease to take advantage of the taxpayer funded subsidies and Fringe Benefits Tax exemptions) for two years.

The Model Y’s lease is about to come to an end and it was time to figure out whether I should refinance (a terrible idea at the moment given the poor resale value and supersized interest rates) or whether I should take out another lease.

I sat down to run through the options and was pretty shocked to see the situation I was in after just two years of a Model Y lease and I wanted to share my experience so others don’t fall for the same trap.

I also wanted to share why I think the prices are going to come down even further again.

Why Tesla prices will fall further

When I sat down to look at what I’d replace the Model Y with, the first thought was just to get another Model Y. It did the job for us – my wife primarily drives it and it has heaps of room inside, great tech and is cheap to operate.

The only real compromises are the design (subjective, but it’s one of the most boring cars on the road) and the nasty ride that is rougher than some hardcore sports cars.

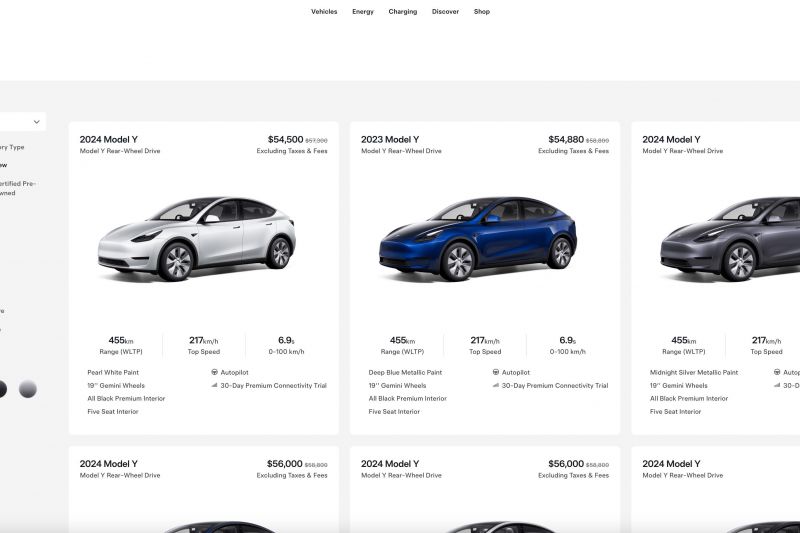

I almost fell off my chair when I saw the price of our car had fallen from a peak of around $72,000 plus on-road costs to just under $56,000 before on-roads.

Barely anything has changed on the car since we bought it, so it’s not as if the price changes over the past two years have been driven by anything other than trying to keep up with other Chinese brands that have launched in Australia.

One of the things that Tesla unintentionally shows its hand with on its website is a delivery estimate. If you see 1-3 weeks on the order page for a new car, it basically means the car is in stock somewhere in the country and you’ll be getting a car fresh off the boat, or one that has been sitting around gathering dust somewhere for a while.

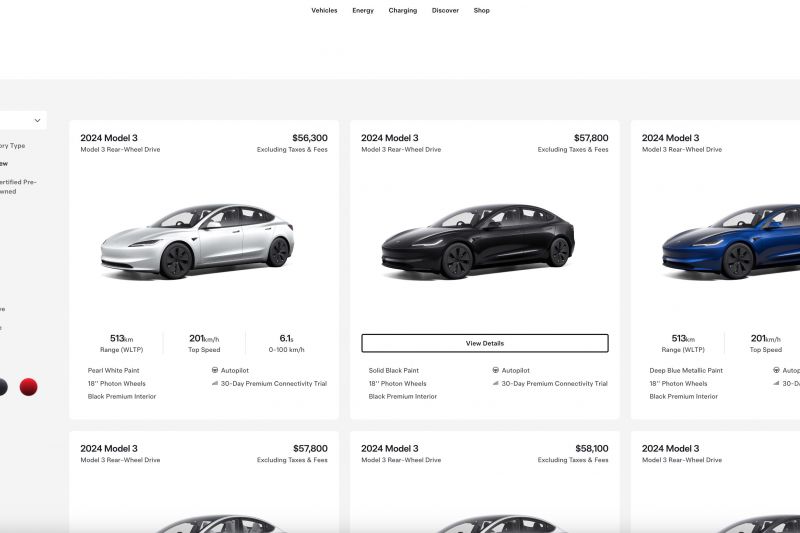

That’s the case at the moment for hundreds and hundreds of Model 3 and Model Y vehicles that continue to arrive by boat, but don’t have any buyers attached to them. A recent 7 News story detailed the deluge of Teslas sitting dormant at the docks in Melbourne with no buyers in sight.

Making matters even worse, if you select the ‘existing inventory’ option on the Tesla site there are hundreds and hundreds of Model Ys available for immediately delivery around Australia. This is a mix of 2023 and 2024 models that never found their way to buyers.

This is the clearest sign yet that within the next month or two Tesla will be forced to drop its prices even further.

I’m tipping another $5k reduction on the Model Y to have it sit at just under $50,000 before on-roads, at least in the short time as Tesla looks to clear stock.

This is also part of the reason I’m going to sit back and wait before ordering our new car.

It was great value for money at $70,000 (ignoring the depreciation driven by Tesla’s constant price cuts) and it’s remarkably good value at the current $56,000 mark. It’ll be crazy good value when it drops below $50,000.

How I and others were burned leasing Teslas

I opted for a two year novated lease for our Model Y.

Just backtracking a moment, for those that don’t know how the taxpayer funded scheme works: when you enter into a novated lease agreement, you lease a vehicle for a set period with repayments aligned with a predetermined depreciation schedule that is set by the government.

At the end of your lease period, you have the option of paying a balloon payment on the vehicle (that is the cost of the vehicle depreciated in alignment with the government schedule), refinancing the vehicle to continue paying a monthly rate or, in some circumstances, just handing the car back.

The advantage is that your running costs and finance costs are repaid out of your pre-tax salary, so you reduce your taxable income. You also don’t pay GST on the initial purchase price (but you do on the balloon payment).

The disadvantage of a novated lease is Fringe Benefits Tax. It’s a tax created to tax employees that get a fringe benefit from their employer that isn’t taxed at their nominal tax rate. In most cases unless your vehicle is used entirely for work purposes, you will pay some portion of tax to the government for the personal portion of the vehicle’s use.

That all changed two years ago with electric and plug-in hybrid electric vehicles. The government declared that they would be FBT-exempt regardless of whether you used the vehicle for work at all.

Typically, a novated lease will be anywhere from 1-5 years and normally it’s done in one-year increments.

Some people have managed to find novated leasing companies that will allow you to do a 13-month lease, for example, but claim two years of depreciation. This isn’t allowed.

Anyway, I ended up going for a two-year lease. My original purchase price was $76,129 on-road. That purchase price meant that my balloon payment at the two-year mark would be just under $44,000.

The beauty of a novated lease is that you could in theory sell the car for more than the balloon payment and pocket the difference. And in some cases that works.

But, in the case of a Tesla, it’s something you want to forget about pretty quickly! My lease ends next month and if I did list the car for, let’s say $55,000 or even $50,000, nobody would buy the car.

Why? Because it’s a two-year old electric car with 25,000km on the clock and a brand spanking new one is $55,900 – why on earth wouldn’t you just buy a brand new one?

So realising this ticking value time bomb, I tried to offload the car as quickly as I could. I ended up using every instant offer service I could get my hands on (including the one on our site) and I was offered everything from $40,000 through to $44,000.

I ended up settling on a figure of just under $44,000, which left my about $3000 out of pocket. I was out of pocket because I had to end the lease two months early so I wasn’t left with a rapidly depreciating asset.

I’ll caveat everything above by saying during that period the vehicle was leased, I was able to get tax benefits from it being an FBT-exempt novated lease.

The issue is that if you are in a lease longer than two years (or even one that ends six months down the track) you can’t just end your novated lease and sell your car.

Well, you can, but you will be hit with paying out the balance of your lease interest, along with termination fees. You also probably won’t be putting money away to the side with the expectation of having a finance balance left to pay.

This offer also won’t be around forever. At the moment novated leasing companies and EV manufacturers are making bank on taxpayer-funded subsidies and things like FBT exemption.

At the moment this scheme ends in 2025 for plug-in hybrid vehicles and will be reviewed in 2027 for battery-electric vehicles. Once there’s mass adoption, the plug will be pulled on this because it’ll be a waste of taxpayer dollars.

At that point you’ll be up for FBT, plus early termination fees if you want to pull the plug early because of rapid depreciation.

I’ll add another caveat. Tesla isn’t the only brand discounting its electric cars – it’s the one I’ve chosen to write about given my personal experience and that it’s the volume seller in each segment it sits in.

How to not get burned with a novated lease

So, you must be thinking to yourself: this guy is crazy for wanting to get another novated lease with a Tesla, right!?

Unfortunately anybody that bought a Tesla over the past two years has paid the price of rapid depreciation. At this stage, it’s highly unlikely the cars will become significantly cheaper in the longer term than they are now.

But, to be sure, I’m putting in some safeguards. I’ll wait a little longer for the price to drop, I’ll also do a one-year lease (for greater flexibility in selling the car and getting out early if required) and, finally, I’m going to switch novated leasing companies to one that allows me to simply hand the car back when the lease ends.

If I had that option last time, I would have left the vehicle with the leasing company and made it their problem. I’d still have the potential upside of selling at a profit, but I’d be safeguarded against potential further depreciation.

My advice is to pick your novated leasing period wisely and also pick a company that offers you to the ability to simply hand the vehicle back at the end of the lease if you so desire.

Also make sure you ask what the interest rates are. Our original two-year Model Y lease was at a rate of 4.5 per cent. This time around, it’s around a 15 per cent comparison rate – that’s even despite the Commonwealth Bank offering a rate around 6 per cent cheaper (and they’re likely to have some of the worst rates around).

Novated leasing companies try and extract as much money as they can from finance and insurance commissions. They want to willow down as much of that tax saving you get as humanly possible so you still get an upside, but they ultimately get a big chunk of the profits – as you’d expect any business in that industry to do.

So anyway, there’s why I think the prices will keep dropping and what you can do to limit the depreciation damage in the future.