Matt Campbell

2025 Porsche 911 Carrera T review

5 Days Ago

Deputy Marketplace Editor

Tesla’s quarterly investor update is in, and it’s not pretty reading for the electric vehicle (EV) manufacturer.

Over the first three months of 2025, Tesla recorded operating income of US$399 million (~A$624 million) – down 66 per cent on the first quarter of 2024.

Automotive revenues were down by 20 per cent, attributed to falling sales across the model lineup. Tesla Model 3 and Model Y deliveries tallied 323,800 to the end of March, a 12 per cent drop on last year, while total deliveries were also down by 13 per cent.

Production also slowed by 16 per cent, with 362,615 vehicles rolling out of the factory.

Hundreds of new car deals are available through CarExpert right now. Get the experts on your side and score a great deal. Browse now.

Tesla noted in its report, however, that during the first quarter of this year it was busily changing over production lines across four of its factories to the updated Model Y.

The company’s struggles date back to last year – in 2024, Tesla delivered fewer than 40,000 vehicles in Australia as a result of sales declining across nine months of the year, even after aggressive discounting plus the launch of the refreshed Model 3.

The looming threat of tariffs and ongoing protests against the involvement of Mr Musk in US politics could extend Tesla’s slump into the foreseeable future.

Tesla noted it would revisit its 2025 guidance in its second-quarter update, while Mr Musk said on the Q1 earnings call that he would dial back his work as the head of the so-called Department of Government Efficiency and acknowledged “blowback” against him for this work.

Mr Musk has drawn both criticism and support since aligning himself with now-US President Donald Trump in the leadup to last year’s election, subsequently becoming a senior White House advisor.

Following the US election, Tesla stock prices reached record highs of almost US$480 (A$751) per share, however this then dropped to about US$220 (A$344) before recently starting to rise once again.

Soon after taking on the top job, President Trump led efforts to introduce a 25 per cent tariff on vehicles imported to the US, 10 times higher than the previous 2.5 per cent duty.

“Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers,” acknowledged Tesla in its investor update.

“This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term.

“While the current tariff landscape will have a relatively larger impact on our Energy business compared to automotive, we are taking actions to stabilise the business in the medium to long-term and focus on maintaining its health.”

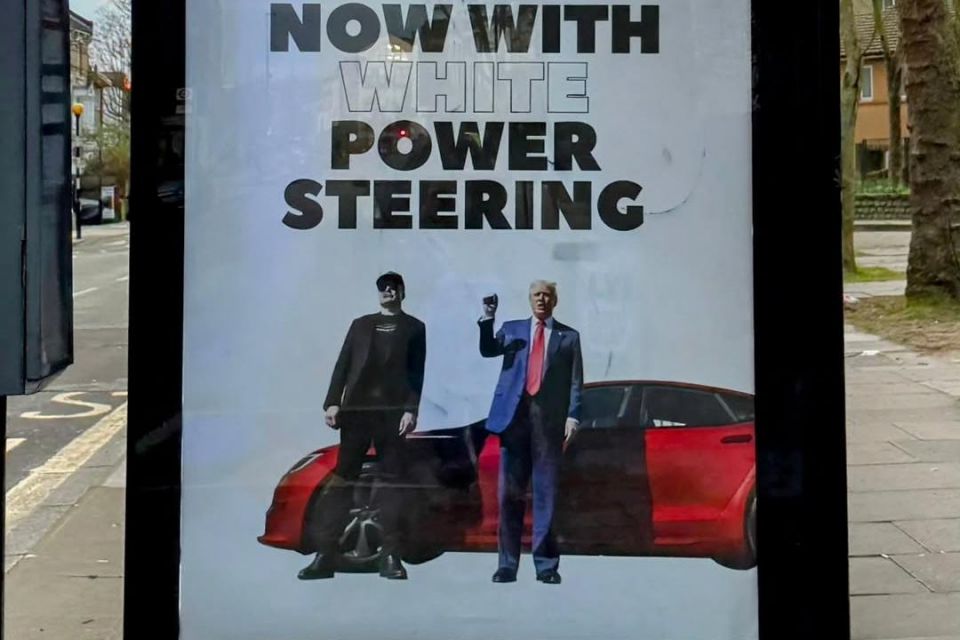

Backlash against Tesla and its outspoken boss has seen buyers of its existing electric vehicles trading them in at a record rate, while there have been reports of vandalised cars in the US and fake billboards attempting to dissuade buyers in Europe.

Increasing competition in the EV space has also contributed to falling Tesla sales. In particular, Australia has welcomed a host of new carmakers over the past 12 months including Deepal, Leapmotor, Xpeng, Zeekr, and Smart, all of which offer rivals for Tesla products.

Established players have also introduced new electric models in that time, saturating the local market.

Mr Musk painted a rosier picture for the company in the earnings call, saying the future of Tesla is “brighter than ever”.

“We’re not on the ragged edge of death. Not even close,” he said.

“I expect that this year will be there’ll probably be some unexpected bumps. But I remain extremely optimistic about the future of the company.”

MORE: Everything Tesla

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

Josh Nevett is an automotive journalist based in Melbourne, Australia. Josh studied journalism at The University of Melbourne and has a passion for performance cars, especially those of the 2000s. Away from the office you will either find him on the cricket field or at the MCG cheering on his beloved Melbourne Demons.

Matt Campbell

5 Days Ago

James Wong

4 Days Ago

Max Davies

3 Days Ago

Josh Nevett

2 Days Ago

Josh Nevett

1 Day Ago

William Stopford

17 Hours Ago