Anthony Crawford

1990 Lamborghini Countach review

6 Days Ago

The Australian Automotive Dealer Association lobbies government and manufacturers, and is led by James Voortman. Here we discuss big-picture issues in car retail

Senior Contributor

Senior Contributor

If you’ve purchased a new car at any point, you’ve almost certainly done so at one of Australia’s approximately 3000 franchised dealer outlets.

The Australian Automotive Dealer Association (AADA) is the chief advocacy body for these franchises to governments, and to car manufacturers.

It has its own management in Canberra, and a board made up of dealers from each state and territory. Its chief executive is former ministerial advisor James Voortman.

Voortman’s challenges are myriad. Car dealers don’t make profit margins like they once did, they must tool-up to maintain a slowly growing fleet of electric cars, and they must be open to enabling a more digital buyer experience. They also must become more welcoming, and less scary, to non-car people.

Voortman is also responsible for securing a code of conduct that enables dealer bodies to negotiate with car manufacturer franchisors from a position of strength, because now is a time of change. The demise of Holden and its subsequent legal mess is just one example.

Car dealers do have power of their own, of course. The AADA claims the new vehicle retailing sector employs more than 55,000 people including 4463 apprentices, has a total turnover of almost $56 billion, and generates more than $2 billion in tax revenue.

He’s therefore a fitting subject for our latest weekend Q&A feature, across his remit and very amiable to boot. The following chat starts by discussing big -picture reform and ways to recover car sales after COVID, before honing in on specificities around buyer experience.

James Voortman: You hit the nail on the head. A lot of dealers were struggling in the years leading up to COVID-19. Deloitte will tell you that in 2019 margins were less than 1 per cent, and about a third of the dealers were making no money at all.

Then look at the start of the year, we had General Motors pull Holden out of Australia. I mean, that virtually wiped out the second biggest dealer network in the country.

So things were very tough heading into this pandemic, and it’s clearly been made even tougher with the unprecedented drop-off in sales.

But I have to say I’ve been quite impressed by the resilience of some of the dealers that adapted to the current climate, and they’ve been able to remain open and then service their customers to the best of the ability.

I have to say that the big sort of game changer was the Job Keeper program that the government announced a few weeks into this crisis, that’s just been critical. It’s stemming some of those job losses and enabling dealers to get through to what we hope will be a recovery phase.

And I guess that reinforces how fortunate we are to be in a country like Australia during this crisis.

JV: I think what we are clearly getting from the government is that they 100 per cent understand that our industry is one that is significantly exposed to a sustained downturn in the economy. And I’m confident they’re listening.

It’s important to remember that some of these things, we have been calling for, for some time. Even before COVID-19 our pre-budget submission was asking for the Instant Asset Write Off to be expanded.

We’ve got a long history of calling for tax reform in our industry. However, as you alluded to, there is no denying that the government is very conscious of the scale of the assistance they’ve provided, and that every decision from here on in will be very carefully considered.

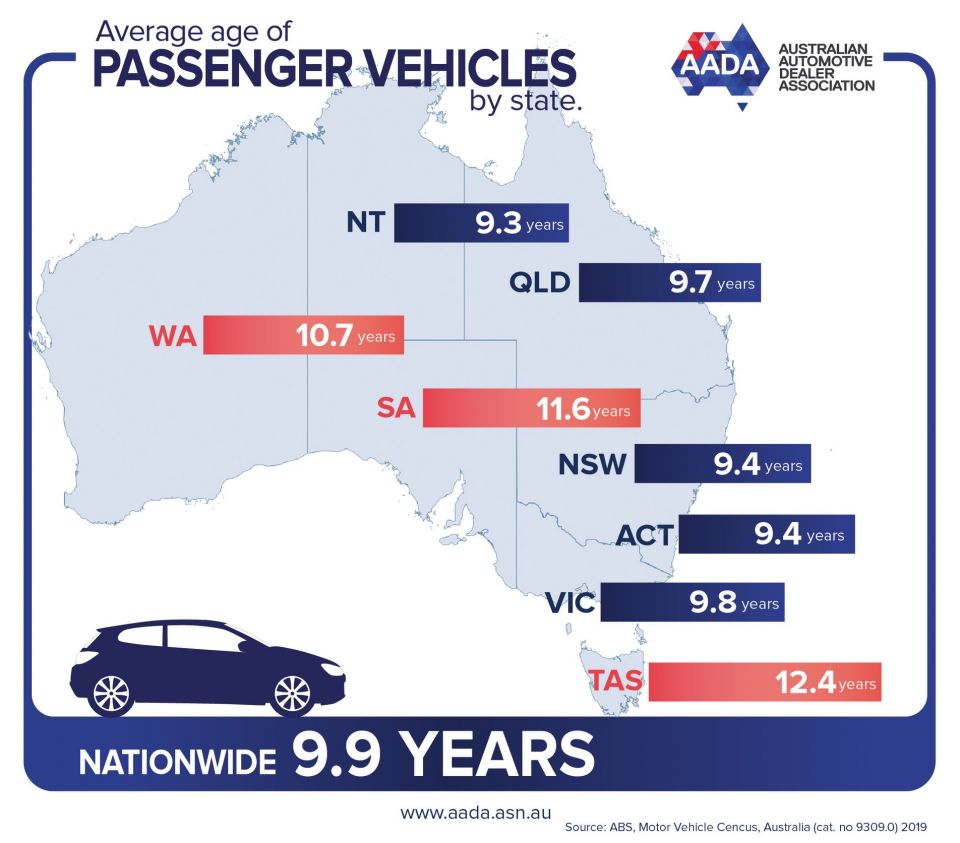

We think we’ve got a pretty strong argument to make. Our industry’s a large employer, and we think the renewal of the fleet is an important goal that Australia should strive towards – not only for improving the safety of the fleet, but also to improve our carbon footprint and lowering the emissions of the fleet, which is higher than other countries.

JV: I think what you have to remember is that new cars in general have lower emissions than the older cars they are replacing, but there’s no denying how far away we are from Europe and the US in terms of our emissions standards, both CO2 emissions and noxious emissions.

So I’m coming around to the idea that, yes, potentially any fleet renewal scheme will have a fuel efficiency requirement built into it, and the vehicles that are able to be accessed under that scheme, would have to hit certain sort of benchmarks.

JV: Look, I wouldn’t say dealers are totally dismissive of moves to an agency model. We’ve always said, manufacturers have the right to change the way in which they distribute their products. However, the very important point is that significant changes to the business model should be done in a fair and transparent fashion.

To the point on fairness, I’d say significant changes to the business should be accompanied by adequate compensation, which reflects investment in capital and time that dealers have put into the brand. I actually don’t think many people appreciate the scale of the investments that manufacturers require dealers to make in things like showrooms, equipment, training, and so forth.

So I think that issue of fairness is central, but also transparency. And on that front, I think OEMs need to provide their dealer partners with the maximum amount of notice when they are considering a move to a new retail model, and I also think they need to give all the facts to their dealers and work with them and address some of the key questions which remain, like how does the trade-in work, will there still be sales targets, and many others.

I can’t predict the chances of the agency model succeeding, but I think the best chance of success would be if the OEMs bring their dealers along on the journey with them.

JV: I spoke to Honda management on the day of the announcement, and I directly addressed this issue with them. You have to put my comments into perspective. The day that was announced was an incredibly anxious time for many businesses across Australia, including dealers.

The government was starting to order some closures of businesses. I think the weekend before that saw pubs and movie theaters and so forth closing. At the time everyone was thinking in our industry, it’s not a matter of if, but when. We were positive that we were going to be shut down.

And also there was no suggestion of the wage subsidy that became JobKeeper. So there was a great degree of anxiety at the time, and I was giving voice to a lot of the anxiety in the industry at the time.

I suppose from Honda’s perspective, and it is important to acknowledge their perspective, their announcement, the week before their announcement there were a number of speculative media reports, which said that they were planning a significant move. And so they probably felt like they just needed to… articulate their plans.

JV: I don’t think it’s too surprising given the circumstances we find ourselves in. A lot of OEMs have been using or working on online platforms, and I guess the pandemic’s just accelerated the need for that.

The question we’re seeing, and I’m sure you are too every day, both in the local and global media, is whether consumers are going to now sort of flock to buying cars online.

And I think the answer is that there is a proportion of consumers that will potentially be more comfortable with buying a car online, and we already have for some years seen that more and more of the car buying process is shifting online.

However, we still think that many consumers aren’t going to feel comfortable buying a car sight-unseen. The challenge for our industry is going to be to develop approaches, which cater both for consumers to interact physically at the dealership and online, and also to create an environment in which you can seamlessly shift between those platforms to create a better customer experience.

JV: It depends on who you’re asking at the moment. And it depends on which brands we’re talking about. Without naming names, there are a small number of very successful brands in Australia who manage to make a success of the traditional model. And with these brands, the OEM will be profitable, the dealer will be relatively profitable, and the customers are flocking to the product.

However, for many other brands, this is not the case. And while I still do think that the traditional model has worked over a number of years, we need to review some of the elements that underpin the model. How do we incentivise dealers, is one question we need to review.

Is the model of building those bricks and mortars, those large, expensive showrooms, and regularly upgrading them – is that necessary or even sustainable? So those are the types of questions we need to be asking.

But look, let’s not forget that many of the most successful retailers throughout the world are not the product manufacturers. Companies like Amazon, Costco, Aldi, to use local examples, are very good at selling the products that are supplied to them, and OEMs have tried selling directly before, and some have discovered that making cars and selling them, often requires a different sort of skill set.

So there are good reasons to review the traditional sales model, especially in a down market, but I think we need to be careful not to throw out the baby with the bath water.

JV: That’s a great question. Yeah, look, I think to be honest, and I’ve spoken about this before, I think there is a reputational issue with car dealers and a lot of it is undeserved.

And I think there’s not often a clear distinction made between some of the franchise new car dealers and some of the used. And I often speak to people who have been blown away by the good service they’ve received in a dealership.

However, you are right. The research does show that many people do not enjoy the process. And I think a lot of that is linked to the car being the second-most, or most expensive purchase for an individual or a household, and that brings with it a large degree of anxiety from a consumer’s perspective.

Dealers do invest huge amounts of time, effort, and money in training and educating their staff because they understand that you really need return business. You need those customers to want to continue servicing their vehicle with you, that you want them to trade their car in, and buy new from you.

So, it’s certainly in our best interest to change that experience. And one thing we have to focus on, I believe, is retaining the staff in our industry. We’ve got too much of a turnover, especially amongst the sales staff.

And the other thing I think we really need to look at is whether the OEMs should move away from this ‘hit your sales target at all costs’ approach, because I think often that pressure does flow through onto the showroom floor, and consumers probably get caught up in the pressure of [sellers] trying to hit sales targets.

So look, we do acknowledge that it can be a daunting process with consumers, and the challenge is undoubtedly there for us to sort of address that.

JV: We need to acknowledge the Federal Chamber of Automotive Industries and all of its members for taking this important step. Cars now have to be registered before they [brands] can report it as sold, and that’s going to improve the integrity of VFACTS.

But we’ve been quite clear, we think that’s only a first step. And the next step should be to exclude registered demonstrators from the data set because under the current system, OEMs can still boost their market share… by encouraging or even incentivising dealers to register demonstrators.

We still think the ultimate goal should be that a sale is only reported when a genuine customer takes delivery of a genuine vehicle.

So to answer your question, a step in the right direction, but more work needs to be done. And I think to their credit, the FCAI have said that they’re always reviewing ways in which to improve the integrity of that pretty important data set, which is used by people who analyze the stock market, governments, statisticians, and others.

JV: If you’d asked me this just before COVID-19, I would have said that the practice continues from certain high volume manufacturers. We have seen some of these practices cleaned up in recent years, but frankly they should be wiped out altogether.

And all I can say is I hope on the other side of this crisis, we see a return to the situation in which OEMs do not compel their dealers to take on unsustainable levels of stock.

JV: You know, obviously I think if you look at consolidation in the industry at the moment, it’s inevitable given the amount of regulatory disruption and margin compression that has occurred in recent times.

The industry is currently operating on very large overheads, but very narrow profit margins. And I think the only way to reduce those overheads at times is through scale, and rationalising of processes. So I think it’s inevitable.

Obviously the AADA would like to create an environment where dealers can compete with one another and margins are better than what they are today. And we’ll keep working for all dealers, large and small. But I think the answer to consolidation, is it’s just a reality of the industry today.

JV: So dealers are franchised by large offshore manufacturers to distribute their product in Australia. And look, there’s a natural power imbalance, not only in Australia, but all over the world between big manufacturers and local dealers.

And the current treatment of Holden dealers by GM, is a case in point. Regardless of whether or not GM had to pull out, the fact is it’s a David and Goliath [situation]. It’s just a fact.

Now in places like the United States, the power balance is recognised and addressed by automotive-specific franchise law, which affords dealers protections against things like unreasonable requests for capital investment, unfair terminations, or failure to honour warranty payments.

Now to be clear, there are some manufacturers who treat their dealers as true partners and their ethics are beyond question. However, there are many examples of occasions where dealers have been left out to dry, and we think that an automotive-specific set of laws in Australia, which the government are currently working on, will go some way towards protecting those businesses and their investments they make.

Anthony Crawford

6 Days Ago

Matt Campbell

5 Days Ago

James Wong

4 Days Ago

Max Davies

2 Days Ago

Josh Nevett

1 Day Ago

Derek Fung

14 Hours Ago