Anthony Crawford

1990 Lamborghini Countach review

5 Days Ago

Raw material costs and inflation drove battery pack prices up by 7 per cent in 2022, says BloombergNEF, and relief isn't expected until 2024.

Senior Contributor

Senior Contributor

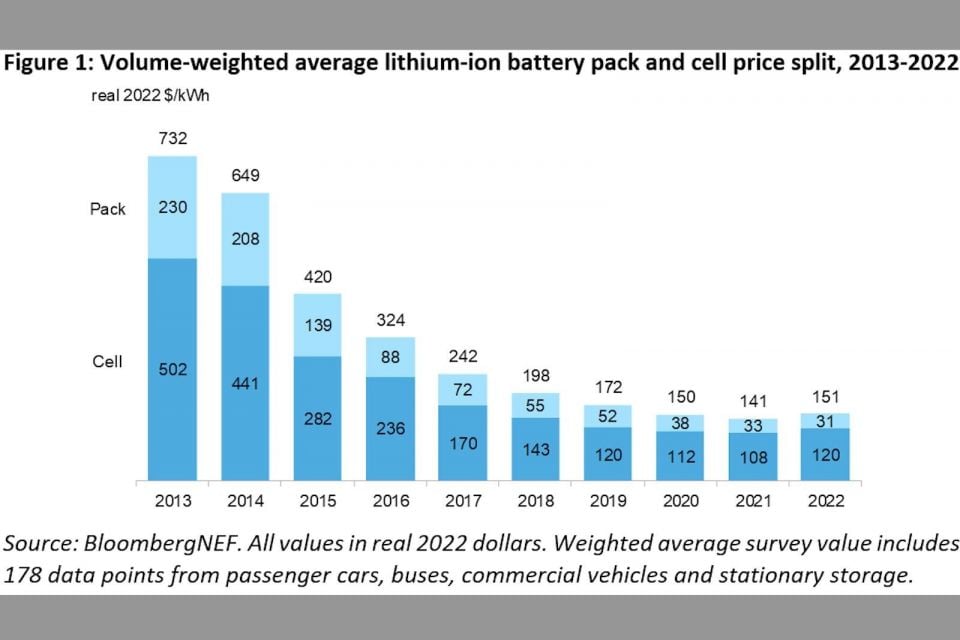

Electric car batteries got more expensive this year on the back of rising material costs and inflation, belying a dozen years of prices steadily tracking downwards.

This is according to leading research company BloombergNEF (BNEF) in its annual battery price survey, which found the price of lithium-ion battery packs grew 7.0 per cent since 2021.

It’s the first increase in battery prices since it began tracking the market in 2010, says BNEF, which found volume-weighted average prices for li-ion packs across all sectors increased to $151 per kWh of capacity ($A226).

Driving the price upwing are rising raw material and battery component prices, and persistent economic inflation – overriding savings gained from burgeoning economies of scale.

“The upward cost pressure on batteries outpaced the higher adoption of lower cost chemistries like lithium iron phosphate (LFP). BloombergNEF expects prices to stay at similar levels next year, further defying historical trends,” the research firm added.

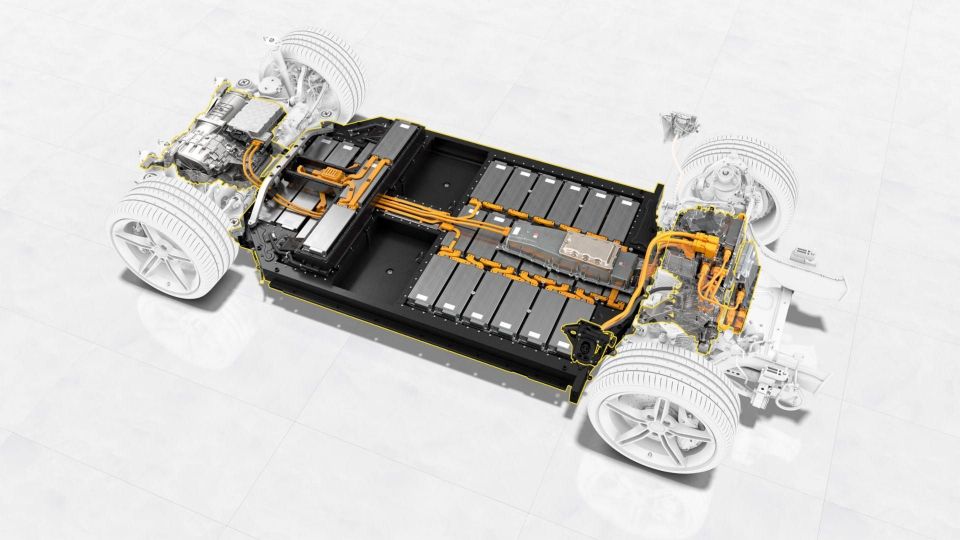

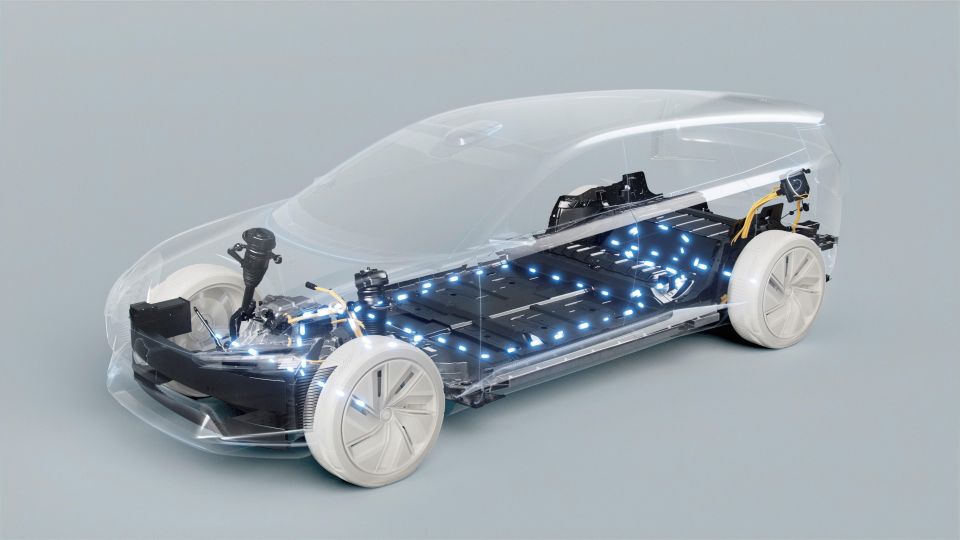

Given batteries are the most expensive component in an EV, cost increases to packs will be an impediment to electric cars becoming more affordable.

It should be noted the above figures represent an average across multiple battery end-uses, including different types of electric vehicles, buses and stationary storage projects.

For battery electric vehicle (BEV) packs in particular, prices were $138/kWh ($A207) on a volume-weighted average basis in 2022. At the cell level average BEV prices were $115/kWh ($A172), meaning on average cells account for 83 per cent of the total pack price.

Over the last three years, says BNEF, “the cell-to-pack cost ratio has diverged from the traditional 70:30 split”. It found this is partially due to changes to pack design, such as the introduction of cell-to-pack approaches, which have helped reduce costs.

Battery pack prices were cheapest in China at $127/kWh ($A190) – explained in part by sheer scale, given China is far and away the world’s biggest market for EVs.

Packs in the US and Europe were 24 per cent and 33 per cent more expensive, respectively.

BNEF contends prices could have risen further in 2022 “had it not been for the higher adoption of the low-cost cathode chemistry known as LFP, and the continued reduction of expensive cobalt in nickel-base cathodes”.

On average, LFP cells such as those used in the Tesla Model 3 and Y, MG ZS EV and BYD Atto 3, were 20 per cent cheaper than lithium nickel manganese cobalt oxide (NMC) cells in 2022 – though LFP pack prices actually rose by 27 per cent across the year.

“Raw material and component price increases have been the biggest contributors to the higher cell prices observed in 2022,” said BNEF energy storage associate and lead author of the report, Evelina Stoikou.

“Amidst these price increases for battery metals, large battery manufacturers and automakers have turned to more aggressive strategies to hedge against volatility, including direct investments in mining and refining projects.”

While prices for key battery metals like lithium, nickel and cobalt have moderated slightly in recent months, BNEF expects average battery pack prices to remain elevated in 2023 at $152/kWh ($A228) in real 2022 dollars.

However BNEF also said it expects battery prices to start dropping again in 2024, when lithium prices are expected to ease “as more extraction and refining capacity comes online”.

BNEF’s 2022 Battery Price Survey predicts that average pack prices should fall below the magical $100/kWh threshold ($A150) by 2026 – albeit two years later than once expected.

“Demand will reach 603GWh in 2022, which is almost double that in 2021. Scaling up supply at that rate of growth is a real challenge for the industry, but investment in the sector is also rising rapidly and technology innovation is not slowing down,” added BNEF head of energy storage Yayoi Sekine.

Anthony Crawford

5 Days Ago

Matt Campbell

4 Days Ago

James Wong

3 Days Ago

Max Davies

2 Days Ago

Josh Nevett

17 Hours Ago

William Stopford

13 Hours Ago