Max Davies

2026 Ram 1500 Rebel review

5 Days Ago

Contributor

Chinese carmakers are well known for being ambitious, and often, at least domestically, delivering on these ambitions. One of the companies that has found traction both at home and abroad is BYD.

Standing for ‘Build Your Dreams’, BYD notably counts American billionaire Warren Buffett as one of its investors, and has recently unveiled plans to begin selling models in Australia through a distributor partner.

MORE: China’s BYD electric brand arrives from $44,381, online

Shenzhen, a Chinese city near Hong Kong, is well known for its electronics manufacturing prowess, and it was here in 1995 that BYD was first founded by entrepreneur Wang Chuanfu.

Having a background in materials science and chemistry and with related experience in academia, and with the Chinese government trialling a limited form of capitalism in the area, Chuanfu made the bold step to compete with the flux of Japanese companies exporting rechargeable batteries at the time by starting his own battery firm.

Thus, BYD was founded as a maker of rechargeable batteries, and grew rapidly by becoming a major supplier of batteries to various mobile phone manufacturers.

Subsequently, Chuanfu wished to enter into a new market for his batteries, and sensing the possibility of vehicles eventually being powered with electricity, decided to make a risky decision to buy struggling Chinese carmaker Qinchuan Auto (renamed to BYD Automobile) as a way to enter the automotive industry and learn how to scale up the mass production of cars.

Chinese companies are often known to be fast followers, and BYD was no exception. By reverse engineering and then building the tooling and moulds required to make a particular part in-house, the firm was able to draw on the expertise of foreign carmakers initially to build derivative models, before incrementally making their own improvements.

Using parts and knowledge from Japanese carmakers such as Mitsubishi and Toyota to mass-produce combustion engined models, BYD pivoted to EVs with the launch of the BYD E6 electric people-mover in 2010.

Today, BYD has a market capitalisation of US$103.58 billion, making it more valuable than established brands including Mercedes-Benz, Ford, General Motors and BMW. In addition to cars, the company also produces a range of commercial vehicles, such as EV buses, forklifts and trucks.

BYD’s original business of manufacturing batteries for mobile phones has been spun off into a separate company, BYD Electronics (which now also manufactures various medical devices and computer components), but this firm maintains a close relationship with BYD Automobile, and the two entities continue to share a logo and branding.

The brand has further increased its prominence recently by attracting high-profile investors, most famously Warren Buffett, who bought a 10 per cent stake in the company in late 2008 for $232 million.

BYD’s current model portfolio consists of both ‘dual mode’ plug-in hybrids and battery electric vehicles. The company has largely limited sales of its plug-in hybrid range to the Chinese domestic market, whilst its battery electric vehicles are sold at home and abroad. This story will focus on the carmaker’s full battery EV range.

One of the firm’s most recent launches is the Tesla Model 3 rivalling BYD Han EV sedan. Offering up to 362kW of power in range-topping ‘Supreme’ trim, it also claims a range of 605km on the very optimistic NEDC cycle in less powerful entry-level variants.

All Han EV sedans make use of a 76.9 kWh LFP (lithium iron phosphate) battery engineered using BYD’s innovative ‘Blade Battery’ design. This uses ‘cell-to-pack’ technology to optimise energy density, whilst also elongating the cells into ‘beams’ that then become essential to the structural integrity of the pack, reducing weight and production costs.

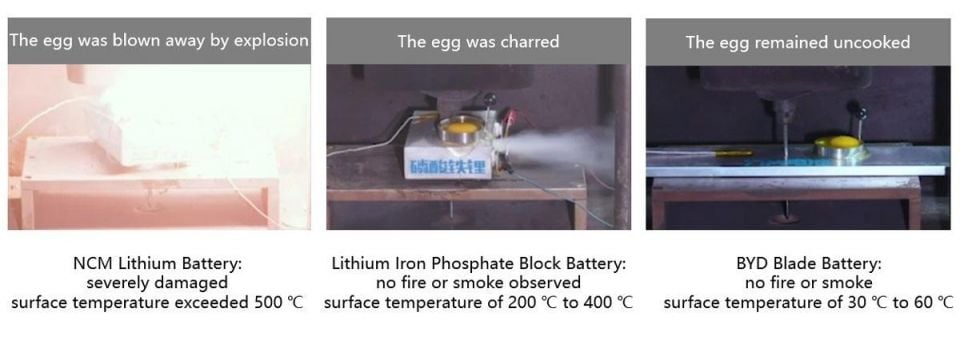

BYD also claims that its Blade Battery is safer than the battery pack designs used in other EVs, with regard to thermal stability and fire risk. The company has creatively demonstrated this by piercing the battery pack with a nail and then placing a raw egg on top of the piercing.

The company claims that the lack of fire or smoke, and the fact that the egg remained uncooked, helps evidence the crashworthiness of the battery. BYD claims that its battery design has also been put through other tests such as being crushed, overcharged and placed in a furnace without exploding or catching fire.

Other EVs currently being produced by BYD include the older Qin Pro sedan (based on an adapted internal combustion engine chassis), as well as the Song Pro and Tang electric SUVs. The Tang SUV is a larger model also available with the Blade Battery and seven seats, and is currently exported to Norway.

Arguably the company’s most important launch is the Yuan Plus EV. Sized in line with SUVs such as the Audi Q3 and BMW X1, this model is expected to go on sale shortly in Australia as the BYD Atto 3 (see below for further details).

BYD has recently revealed plans to sell the Atto 3 SUV in Australia.

This car will also make use of the brand’s Blade Battery technology, and with a starting price of $44,381 before on-road costs, claims to offer 320km of range from a 50.1kWh battery, while an extended range version offering 420km of range (from a 60.4 kWh battery) will also be available for an extra $3000.

The brand’s local importer EVDirect.com initially claimed that it had struck a partnership with servicing centre network Mycar (formerly Kmart Tyre & Auto), whereby customers would exclusively purchase the car online before collecting (and servicing) it through their local Mycar store.

More recently, the brand has had a change of tack and has additionally announced an intention to partner with dealership giant Eagers Automotive to sell the car through the Eagers network.

Previously, the brand claimed to be selling Australia’s cheapest electric car, the T3 electric van, as well as the E6 people mover, but it is uncertain how many, if any, of these models have been sold. BYD is has also committed to selling its Dolphin small hatch in Australia shortly.

In a sign of the company’s ambitions reflecting its namesake, the company has also announced plans to become a top five brand in the Australian new car market by the end of 2023.

Listed on the Hong Kong Stock Exchange, BYD is the fourth largest automaker in the world by market capitalisation, producing more than 1.5 million vehicles since being founded, with a record 603,783 units sold in 2021.

MORE: Brand overview, Xpeng MORE: Brand overview, China’s Human Horizons, aka HiPhi MORE: Brand overview: Nio

MORE: Local BYD importer appoints mycar to be delivery, service partner MORE: BYD Yuan Plus electric SUV locked in for Australia MORE: BYD T3 van becomes Australia’s cheapest electric car MORE: Electric 2022 BYD E6 set for local launch with $40k list price MORE: BYD’s importer takes huge EV order from Uber partner MORE: BYD promises to slash Australian electric car prices

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

Max Davies

5 Days Ago

Max Davies

4 Days Ago

Neil Briscoe

3 Days Ago

Max Davies

2 Days Ago

Alborz Fallah

18 Hours Ago

Damion Smy

18 Hours Ago