Shane O'Donoghue

2025 Nissan Ariya Nismo review: Quick drive

5 Days Ago

With car manufacturers fighting slow supply of new vehicles, it's unlikely used car prices in Australia will drop dramatically until the middle of 2022.

Contributor

Contributor

The growth of used-car prices in Australia has slowed for the first time since April 2020, but we’re a long way from a return to pre-pandemic prices.

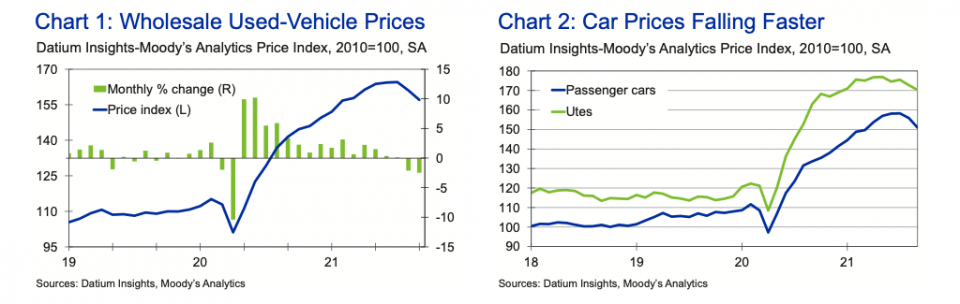

Data from Moody’s Analytics reveals used cars prices dropped by almost five per cent in August and September compared to their July 2021 peak.

Prices are still up more than 10 per cent on the same point in 2020, however, and are 36 per cent higher than before COVID-19 hit Australia early in 2020.

The global semiconductor shortage shows no signs of abating and supply of new cars remains tight; Toyota recently forecast delays of up to 10 months on its most popular new cars due to COVID in its south-east Asian factories and the semiconductor crunch.

Despite the gradual price slowdown, then, it’s unlikely used-car prices will snap back to pre-pandemic levels any time soon. That’s especially true of light commercial vehicles such as the Toyota HiLux.

“Barring any un- foreseen setback in the Australian economy, prices will remain well-supported by steady demand and a lack of inventory on the new- and used-vehicle market,” the latest Moody’s Analytics Price Index report says.

“Australians are likely to remain wary of public transportation as community transmission picks up following the end of the lockdown, pushing up additional demand for private transportation,” the report says.

“Used-vehicle prices are expected to move sideways until midway through 2022 when the new-vehicle market’s supply-chain issues have been worked out.”

Having reported on huge month-on-month price rises since April 2020, Moody’s earlier this year predicted used-car values would start to stabilise through the second half of 2021.

“The end of used vehicles as an appreciating asset despite usage is upon us,” the August used-car value report says.

“It took a confluence of unpredictable circumstances… to flip the market on its head. It will not take that much for the market to return to normal.”

Scott Collie is an automotive journalist based in Melbourne, Australia. Scott studied journalism at RMIT University and, after a lifelong obsession with everything automotive, started covering the car industry shortly afterwards. He has a passion for travel, and is an avid Melbourne Demons supporter.

Shane O'Donoghue

5 Days Ago

Anthony Crawford

4 Days Ago

Matt Campbell

3 Days Ago

James Wong

2 Days Ago

Max Davies

1 Day Ago

William Stopford

19 Hours Ago